2008 world nuclear industry status report: Global nuclear power

By Mycle Schneider | September 16, 2008

Last Thursday, in the midst of the world media’s constant nuclear revival reportage, the International Atomic Energy Agency (IAEA) had an embarrassing announcement to make. While it has increased its projections for nuclear generation in 2030, nuclear’s share of global electricity generation dropped another percentage point in 2007.

Last Thursday, in the midst of the world media's constant nuclear revival reportage, the International Atomic Energy Agency (IAEA) had an embarrassing announcement to make. While it has increased its projections for nuclear generation in 2030, nuclear's share of global electricity generation dropped another percentage point in 2007. The world's nuclear electricity generation had decreased by 2 percent in 2007–in the European Union (EU) it dropped 6 percent–more than in any other year since the first fission reactor was connected to the Soviet grid in 1954. The drop by about 60 terawatt hours corresponds to the average annual generation of 10 reactors.

Major contributing factors were the seven units at Kashiwazaki, Japan, which have remained shut down since a severe earthquake shook the region in July 2007; the up to six German reactors that have been taken off the grid simultaneously for major repairs; and the numerous French reactors that have undergone inspections and maintenance after a generic problem was identified in their steam generators. The latter issue is expected to cost the French nuclear fleet another 2-3 percent of its average load factor for 2008 and through 2009. The "Big Six" nuclear powers–the United States, France, Japan, Germany, Russia, and South Korea–saw their global share of nuclear-generated electricity drop from about three-quarters in previous years to 68 percent in 2007.

At the beginning of September, there were 439 operating nuclear reactors worldwide, five less than five years ago, with a total installed capacity of 372 gigawatts in 31 countries. No new nuclear plant has come online since the beginning of the year.

The installed capacity has increased slightly through "uprating," or technical improvements at existing plants that increase electricity generation. According to the World Nuclear Association (WNA), the U.S. Nuclear Regulatory Commission (NRC) has approved 110 uprates since 1977, a few of them "extended uprates" of up to 20 percent. An additional seven uprates are to be completed through the end of the year. As a result, close to an additional 5 gigawatts were added to the U.S. nuclear capacity through uprates alone–the equivalent of about four new plants. Europe is experiencing a similar trend of uprates and life extensions of existing reactors.

The capacity of the global fleet increased between 2000 and 2004 by about 3 gigawatts per year, much of it through uprating. That dropped to 2 gigawatts per year between 2004 and 2007 and to about 0.5 gigawatts over the first eight months of 2008. These figures should be compared to the global net increase in all electricity generating capacity of an estimated 150 gigawatts for all new power plants, from fossil-fuelled facilities to renewable energy, per year. That leaves nuclear energy with an insignificant fraction in the global power marketplace.

In 2007, nuclear power plants generated 2,600 terawatt hours, about 14 percent of the world's commercial electricity (down from 15 percent in 2006 and 16 percent in 2005) or less than 6 percent of the commercial primary energy and on the order of 2 percent of final energy. Only five countries (Armenia, Romania, Slovenia, South Africa, and Switzerland), which together operate 11 nuclear plants, increased their nuclear share in the power mix in 2007 over the previous year. Fifteen countries remained stable (less than a 1 percent change) and in 11 countries the role of nuclear power declined. (See chart.)

Construction sites in the 14 countries that are currently building nuclear power plants are accumulating substantial and costly delays. At the end of August, the IAEA listed 35 reactors as "under construction," which is one more than at the end of 2007, but 18 less than at the end of the 1990s. The total capacity is just under 28,300 megawatts with an average size of 800 megawatts per unit. A closer look at the list illustrates the level of uncertainty associated with reactor building:

- Eleven reactors, almost one-third of the total listed, have been under construction for more than 20 years. The U.S. Watts Bar 2 project holds the record with an original construction start in December 1972 (subsequently frozen), followed by the Iranian Bushehr plant that was started by German Siemens in May 1975 and is now to be finished by Russia.

- Fifteen projects don't have an official start-up date, including all seven of the Russian projects, two Bulgarian reactors, and three of the six Chinese units under construction. In fact, one Russian plant (Balakovo-5), which had been listed since 1987 and was to go online by the end of 2010, was abandoned and pulled off the list earlier this year. It was replaced by a new project (Novovoronezh 2-1) without any indication of a planned start-up date.

- Two-thirds of the under-construction units have encountered significant construction delays, pushing back officially announced start-up dates. Only 10 projects haven't indicated delays, they are three Chinese, one Pakistani, three South Korean, and three Russian units. They were all started within the last three years and haven't reached their projected start-up dates yet, which makes it difficult or impossible to assess whether they are on schedule.

The geographic distribution of nuclear power plant projects extends the trend of previous years. Between 2004 and 2007, 14 nuclear plants, the total number of units that started up during that time, were located in Asia or Eastern Europe. Similarly, 30 of the 35 reactors currently "under construction" are also located in those regions. The average global construction time for nuclear plants (more than nine years for the 14 most recent ones) isn't a useful metric because of great differences between countries. The four reactors that started up in Romania, Russia, and Ukraine took between 18 and 24 years, while the 10 units that were connected to the grid in China, India, Japan, and South Korea took only five years to complete on average.

Lead times for nuclear plants don't only include construction times but also long-term planning, lengthy licensing procedures in most countries, complex financial negotiations, and site preparation. In addition, in most cases, the grid system has to be upgraded, often with new power lines that have their own planning and licensing difficulties. In some cases, public opposition is significantly higher in regards to high-voltage power lines than for the nuclear plants that generate the electricity. NRC Chairman Dale Klein noted that potentially necessary grid extensions could lead to further delays of nuclear projects and indicated that he was surprised to learn that "it may take as long to site, permit, and build a transmission line for a new plant as to site, license, and build the plant itself."

In the past, nuclear planning has rarely turned out to be accurate. In an article entitled "President Offers Plans for Revival of Nuclear," the New York Times reported that the administration "today formally specified the steps it will take to revive commercial nuclear power." That piece appeared in October 1981 and the president was Ronald Reagan. Twenty years later the "nuclear revival" is once again on the agenda, with President George W. Bush promoting Nuclear Power 2010.

In October 2001, as part of Nuclear Power 2010, the Energy Department planned to "complete construction and deploy multiple commercially viable new nuclear plants by 2010," and at a minimum deploy "at least one light water and at least one gas-cooled reactor." Reality is quite different, and it's now obvious that no new U.S. plant will be up and running by 2010. Energy's July 2008 update on the status of commercial nuclear reactor licenses lists nine submitted applications for combined construction and operating licenses (COL) and a further 10 intended applications. Only one unit is currently planned to operate under a new license before 2015. NRG Energy plans to start construction at its South Texas site as early as 2009 with grid connection in 2014. NRG's COL is currently under review by the NRC. However, as Energy points out, "There is no assurance that any of these plants [which it licenses] will ultimately be built or operate commercially," and "COL filings often include a goal to 'keep the nuclear option open' rather than full commitment [to construction]."

Moody's Investor Services, which provides risk analysis to the capital markets, expects extensive legal cases: "We believe the first COL filing will be litigated, which could create lengthy delays for the rest of the sector." The Financial Times obtained confidential government documents that confirm a similar situation in Britain: "Fresh legal challenges are expected to hamper plans to build new nuclear power stations in [Britain]."

Without any significant new build for years, the average age of the world's operating nuclear power plants has been increasing steadily, now standing at 24 years. Some nuclear utilities envision reactor lifetimes of 40 years–or even 60 years. Considering that the average age of the 119 units that have already been shutdown is 22 years, the doubling of operational lifetime seems rather optimistic. If one assumes an average lifetime of 40 years for all the world's operating reactors (with the exception of 17 remaining German units that, according to German legislation, will be shut down after an average operational lifetime of 32 years) and the 20 units that were under construction as of January 2008 that have an official start-up date (down from 24 units at the start of the year), one can calculate how many plants would be shut down year by year over the next 50 years–see chart.

The exercise enables an evaluation of the number of plants that would have to come online over the next several decades simply to maintain the same number of operating plants around the world. In addition to units under construction with a scheduled start-up date, 70 reactors (generating 40,000 megawatts) would have to be planned, completed and started up by 2015–one every month and a half–and an additional 192 units (168,000 megawatts) over the subsequent decade–or one every 18 days.

The achievement of the 2015 target is simply impossible from an industrial point of view, which means that the number of operating reactors will decline over the years to come unless lifetime extensions beyond 40 years become standard, which would raise safety and maintenance questions. The overall replacement of some 260 units by 2025 seems equally unlikely.

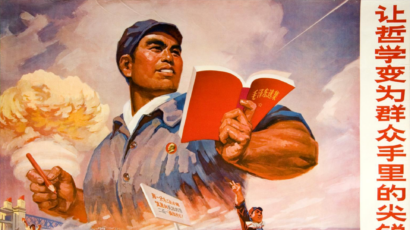

The international nuclear industry lobby, however, claims it can do that and more. The WNA has stated: "It is noteworthy that in the 1980s, 218 power reactors started up, an average of one every 17 days. . . . So it is not hard to imagine a similar number being commissioned in a decade after about 2015. But with China and India getting up to speed with nuclear energy and a world energy demand double the 1980 level in 2015, a realistic estimate of what is possible might be the equivalent of one 1,000 megawatt unit worldwide every 5 days."

Such a "realistic estimate" seems hard to believe. The situation in the second decade of the twenty-first century will be radically different from that in the 1980s. The nuclear industry will not be in the same position it was in the 1980s, when it started to harvest the early heavy investments made in nuclear. At that time, it also didn't have to deal with the nuclear waste issue, which was simply put on the back burner, nor the cost of reactor decommissioning, which was underestimated. In that earlier period, the nuclear industry still appeared progressive, attracting young and talented people. And ferocious competitors such as modern natural gas, combined heat and power, and various renewable energy sectors didn't exist.

The replacement of the aging world nuclear fleet or even the extension of the operating plants encounters three major problems:

- Limited industrial capacity. In the 1980s, there were about 400 nuclear suppliers and 900 nuclear-certified companies in the United States. These have shrunk to fewer than 80 suppliers and 200 certifications in recent years. Even if some of this is due to corporate takeovers, the decline is dramatic. Currently there is only one steel plant in the world, owned by Japan Steel Works that can fabricate the 450-ton ingots needed for so-called generation III reactors such as the Franco-German European Pressurized Water Reactor (EPR). A nuclear power plant construction infrastructure assessment by Energy concluded that major equipment (reactor pressure vessels, steam generators, and moisture separator reheaters) for the near-term deployment of generation III units would not be manufactured by U.S. facilities and would result in procurement and construction delays.

- Skilled worker shortage. According to Power Engineering, Art Stall, Florida Power & Light Company's senior vice president and chief nuclear officer, told the American Nuclear Society's 2007 annual meeting that the nuclear industry's revival has been slowed down by the challenges of building new nuclear power plants, which includes finding qualified craft labor, technicians, engineers, and scientists to support both construction and operation. He said that 40 percent of current nuclear plant workers are eligible for retirement within the next five years and that only 8 percent of the workforce is less than 32 years old. While students studying nuclear engineering and other nuclear-specific technical subjects are increasing, there is much competition from other industries for talent. "[T]he nuclear industry must become creative if it is going to entice these graduates to enter and remain in the nuclear field," he told the crowd. The situation is similar in most European nuclear countries.

- Skeptical financial markets. Standard & Poor's, the credit rating company, warned in May 2007, "In the past, engineering, procurement, and construction contracts were easy to secure. However, with increasing raw material costs, a depleted nuclear-specialist workforce, and strong demand for capital projects worldwide, construction costs are increasing rapidly." In October 2007, Moody's delivered a striking analysis of the U.S. nuclear sector, saying it did "not believe the sector will bring more than one or two new nuclear plants online by 2015." It concluded that it believed many of the current expectations for nuclear were "overly ambitious." Moody's had more bad news for the industry when its June Global Credit Research paper concluded, "The cost and complexity of building a new nuclear power plant could weaken the credit metrics of an electric utility and potentially pressure its credit ratings several years into the project." Even the Nuclear Energy Institute, the industry's trade organization, admitted in an August white paper, "There is considerable uncertainty about the capital cost of new nuclear generating capacity."

After thorough analysis it seems surprisingly evident that contrary to the public's perception and the industry's efforts, nuclear power will continue its long-term decline rather than move toward a flourishing future revival.

This series is a select update of the author's "World Nuclear Industry Status Report 2007," which he prepared for the Greens-European Free Alliance in the European Parliament.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Topics: Nuclear Energy