Why Egypt’s new nuclear plant is a long-term win for Russia

By Marina Lorenzini | December 20, 2023

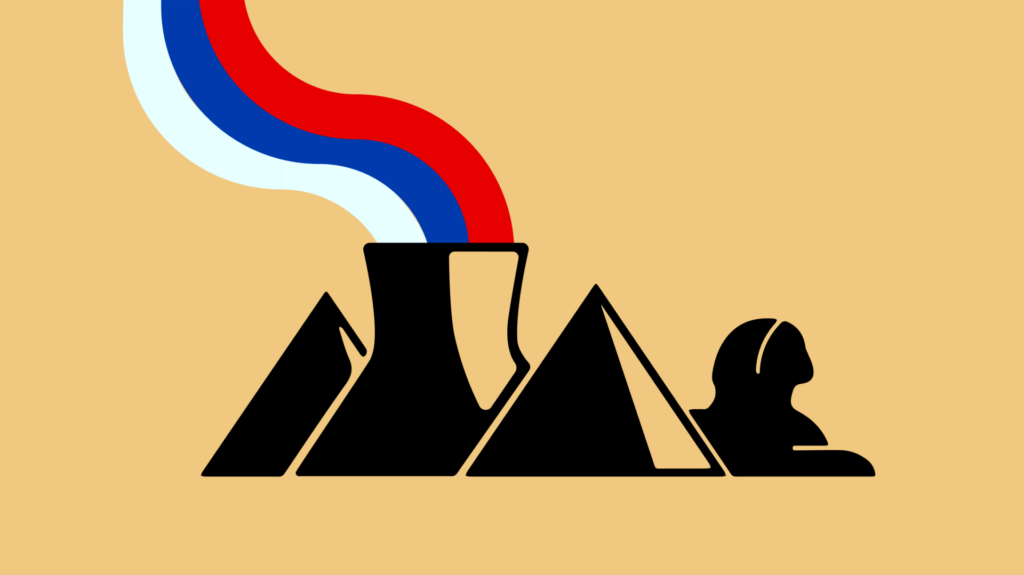

Illustration by Erik English; ii-graphics via Adobe.

Illustration by Erik English; ii-graphics via Adobe.

With 22 countries pledging to triple global nuclear energy production by 2050 at the COP28 climate meeting in Dubai, sincere prospects for growth in global nuclear energy market is on the table. Nonetheless, these 22 countries largely represent ones that have minimal ties with Russia’s nuclear exports or are seeking to decouple themselves from a current dependency.

Many other countries are considering the option of nuclear energy, and several will turn to Russia’s state-owned nuclear energy company, Rosatom, to build their new reactors. Since assuming power, Russian President Vladimir Putin has developed Russia’s nuclear industry exports as a key piece of its energy and geopolitical portfolio. Rosatom currently holds about 70 percent of the global export market for construction of new nuclear power plants. According to the conglomerate’s disclosures, its exports exceeded $10 billion in 2022, with a schedule of upcoming international orders amounting to about $200 billion over the next 10 years.

One country in particular has embraced a partnership with Rosatom: Egypt. In 2015, Russia and Egypt concluded an intergovernmental agreement that led Rosatom to build a $30-billion nuclear power plant near the Mediterranean coastal town of El Dabaa, about 170 kilometers west of Alexandria. With four Russian-designed, 1.2-gigawatt, VVER reactor units, the El Dabaa nuclear power plant is expected to generate more than 10 percent of total electricity production in Egypt and provide a consistent baseload power source for 20 million people.

While Rosatom pursues partnerships with nuclear newcomer states, El Dabaa serves as a revealing case study for analyzing the uncertainties and potential risks of Russia’s nuclear exports. In search of political diversification, Cairo has widened its exposure to debt risk as Russia is building one of the country’s most critical infrastructure assets. With President Abdelfattah Al-Sisi clinching a third term in this month’s presidential elections, how the El Dabaa nuclear plant will alter the overall Russia-Egypt relationship—perhaps even undermining Egyptian sovereignty—is ripe for review.

The plant. After contracts entered into force in 2017, the Egyptian Nuclear Regulation and Radiological Authority (ENRRA) approved construction for the site in 2019. The four main sets of contracts are not publicly available, but they cover engineering, procurement, and construction; nuclear fuel services; operation, support, and management; and spent nuclear fuel treatment.

Construction for Unit 1 began in July 2022 and Unit 2 began in November 2022. The first concrete was poured into the foundation for Unit 3 in May 2023, and Unit 4 received a license from the Egyptian Nuclear and Radiological Regulatory Authority in August 2023. Unit 1 and 2 are currently projected to be connected to the electric grid and commercially viable in 2028, with Unit 3 for 2029 and Unit 4 for 2030.

In addition to producing electricity, El Dabaa will also have the capacity to desalinate coastal seawater. Desalinated water will be used to fill and replenish the primary and secondary loops of the four reactors, sustain the industrial and emergency water supplies for the plant, and provide drinking water to maintenance personnel. According to Rosatom, El Dabaa could expand desalination capacity to 100,000 cubic meters per day, on par with a facility under construction in Tunisia. Such a prospect would align with Cairo’s long-term efforts to build more desalination facilities, provide reliable sources of water for the general population, and mitigate the impacts of the Grand Ethiopian Renaissance Dam on flows of the Nile River into Egypt.

Risks to Egypt from Rosatom’s offer. At El Dabaa, Moscow has agreed to provide funding for 85 percent of the cost ($25 billion), with Cairo committed to raising the remaining 15 percent ($5 billion) for construction costs, import of specialized equipment, and technical and managerial expertise. It is unclear how Cairo will generate $5 billion for this project anytime soon. Egypt is one of the world’s most vulnerable countries for sovereign debt risk (only second to war-torn Ukraine). And the lack of dollar availability, more anticipated rounds of currency devaluation, and scarce donor appetite from Gulf states only exacerbates the country’s economic woes.

Even if the International Monetary Fund or Gulf countries strike a deal with Cairo to alleviate sovereign debt pressure in exchange for greater involvement in the Gaza conflict, the current leadership’s slow pace of reforms is unlikely to change. In the next decade, El Dabaa has the potential to produce some positive impacts, but it will also deepen the bilateral Egypt-Russia relationship and may push Cairo into a dependency on Moscow in some arenas.

Each reactor is designed to have an operation period of about 60 years. This is typical for a reactor lifetime and is consistent with one of Rosatom’s other notable nuclear power plants, built in Akkuyu, Turkey. With an operational extension, it could go for as long as an 80-year total. At El Dabaa, from the time the contracts entered into force in 2017 to the end of service life of the fourth reactor expected to be in 2110, the Egyptian state will have maintained a contractual relationship with Russia for nearly a century, notwithstanding the subsequent plant’s decommissioning phase. In turn, Russia will maintain leverage over an infrastructure asset critical to Egyptian energy security, with potential geopolitical repercussions that may be felt beyond Egypt’s borders.

At El Dabaa, Rosatom has proposed a novel build-own-operate (BOO) model, whereby Russia provides funds for the nearly all construction cost in exchange for, in part, a repayment plan based on future electricity revenues. The BOO model stands in contrast to the typical model for public-private infrastructure projects, called the build-operate-transfer (BOT), in which the private entity returns control of the infrastructure asset after getting its financial investment back.

But with a goal to achieve a domestic nuclear power program and a weak financial position to do so, the Russian offer was one that Egypt couldn’t refuse. In the early 2000s, President Hosni Mubarak put aside his hesitations about nuclear energy risks, in part resulting from the 1986 Chernobyl disaster, and revived Egypt’s quest for nuclear power with an eye toward diversifying domestic energy sources. However, Cairo struggled to attract nuclear industry suppliers from China, France, South Korea, and the United States to export reactors or entire nuclear power plants, likely because of a lack of sufficient financial guarantees and uncertain commercial value. This remained the case until Moscow became willing to offer heavy up-front financing, a hallmark of the BOO model. But industry experts wonder about the contours of the 2017 contracts, whether Egypt will ever be able to fully operate the plant, and whether the host country will ever receive a transfer at all.

(At the moment, Egypt’s Official Gazette, which would typically publish Al-Sisi’s Decree No. 484 from 2015, is entirely offline. However, analysts can refer to reporting of the intergovernmental agreement from Parlmany, a government-controlled media outlet, for a reproduction of the decree.)

At El Dabaa, Russia’s financing of the construction cost represents approximately $25 billion, according to an agreement signed between the Egyptian and Russian ministries of finance. The funds are repayable over a period of 22 years in 43 equal semi-annual installments. (The first installment is due on October 15, 2029). Egypt can repay the Russians in US dollars or Egyptian pounds, whichever most favors the Russian party. The two respective ministries of finance must approve the use of any other currency. Egypt will pay a very favorable interest rate of 3 percent annually, accruing from the date of using each disbursement.

Of the remaining 15 percent ($5 billion) of the power plant’s costs that Egypt must raise under the agreement, the Ministry of Electricity and Renewable Energy stated in 2020 that “Egypt will pay its value by selling the energy generated from the nuclear reactors. This project would not be costing Egypt anything.” The statement alludes to a power purchase agreement, a typical arrangement for infrastructure projects. But this statement ignores the pricing aspects of most power purchase agreements.

For this contract, Rosatom likely negotiated a pricing rate at which it will sell Egypt the electricity to recover its construction and operating costs. Aside from understanding the rate itself, once the Rosatom disbursements end in 2028, it is not clear whether Egypt will have access to some share of the electricity production from the outset (effectively, selling electricity to itself to raise some of the $5 billion), or if the electricity generation will be exclusive to Rosatom for the initial years of operation, or whether Rosatom will be entitled to a percentage of profits for the operational lifetime of the NPP.

However concerning the prospect, a foreign contractor maintaining operational control without eventual transfer has precedent in the Middle East: In 2016, a South Korean utility company won the contract to operate the United Arab Emirates’ Barakah nuclear power plant for the 60-year operational lifetime of the reactors. However, the Emirates’ economic position is hardly comparable to that of Egypt.

Analysts should seriously consider the possible scenario that would ensue should Egypt fail to repay Russia in a timely manner. If this were to happen, Moscow may not seize control by force of the plant’s site like the Zaporizhzhia NPP in Ukraine or seize assets like the Finnish utility Fortum, but it may still leverage Cairo in other arenas where a direct quid pro quo is less evident.

Fuel delivery and waste management. The contracts stipulate that Rosatom will not only build the plant, but will also supply nuclear fuel to the reactors for the lifetime of their operation. Matching the reactor designers and the nuclear fuel suppliers is typical across the industry. It also relieves Egypt of the financial and manufacturing burden to produce a wholly indigenous fuel cycle (uranium mining, conversion, enrichment, and fuel fabrication) for nuclear fuel compliant with the Russian reactors.

At El Dabaa, supplying nuclear fuel is only half of the incentive; Russia is also set to be involved in the management of the spent nuclear fuel, a byproduct of the reactor operation. Egypt has opted for an open fuel cycle, which likely means that El Dabaa will store the waste on site for a few years until Rosatom returns the spent nuclear fuel to Russia, whether for reprocessing or long-term storage. This alleviates the need for Egypt to develop a costly long-term storage solution, like Finland’s deep underground repository.

The often-remarked “take back” offer is an attractive feature of the BOO model and will likely also take place at the Rooppur nuclear power plant in Bangladesh and the Akkuyu nuclear power plant in Turkey currently under construction. The offer has some precedent in the 2005 Iran-Russia nuclear fuel agreement, whereby Rosatom exclusively provides nuclear fuel to Iran’s Bushehr nuclear power plant. Overall, this offer would lessen the financial and political strain on Egypt to host the waste, while also allaying some proliferation and environmental criticism.

However, the fuel agreement may also lock Cairo in a situation where the government is dependent on a Russian fuel delivery and Moscow can take the plant offline in order to ensure payments, as occurred with Iran’s Bushehr plant during the summer of 2021. Similar to how the Iran-Russia relationship has transpired, El Dabaa may serve as a stick, but also a symbolic carrot—a sign of the durability and value of the Russia-Egypt relationship, an attempt at political diversification for Al-Sisi. The power plant may also lead to mutually-beneficial bargains in other security-related domains.

Maintaining Egypt’s sovereignty. Under the current leadership, prospects for Egypt to restructure its debt, enact agreed-upon reforms, and achieve a better economic position in the next decade are dim—and Moscow is well positioned to take advantage of this vulnerability.

In agreeing to the Russian program, Al-Sisi has also tethered his country, by many metrics, to an isolated regime and unprosperous country. While construction at El Dabaa has so far largely gone according to plan, analysts should not take this progress for granted. As sanctions and the war effort in Ukraine continue, Moscow may deprioritize such overseas projects and give preference to its own military budget, civil servants, and infrastructure.

This is not a new story. Up until now, the El Dabaa case has shown similarities to other large infrastructure projects developed by a major global power, including the Hambantota Port in Sri Lanka. In such cases, developing countries allow major powers to build costly and highly technical infrastructure projects that turn sour economically and become debt traps. A lot of these characteristics seem to be present in the El Dabaa site, which will make Cairo vulnerable to Russian conditions for the next century.

To maintain a level of independence, Cairo should seriously engage with the International Monetary Fund and continue to build up a competent indigenous workforce capable of fully operating and maintaining a nuclear power plant. In addition, recent efforts by Canada, France, Japan, the United Kingdom, and the United States will bolster the global nuclear fuel supply chain and may be an option later on for El Dabaa to maintain options for alternatives and diversity of supply on site.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: Egypt, El Dabaa nuclear power plant, Rosatom, Russia, energy security, nuclear exports, nuclear fuel, nuclear power

Topics: Nuclear Energy

Good review of the Egyptian nuclear project and the risks involved in it. Basically, Egypt is mortgaging its energy security for the next century. Russia is not retrograding the spent fuel back home as a favor to Egypt. Russia reprocesses spent fuel from domestic and its export reactors to make mixed oxide fuel (MOX) which substitutes PU-239 for U235 in LWR fuel assemblies. MOX fuel is then available for Russia’s fast reactors – the BN-600, BN-800, and, sometime in the future, the BN-1200. Russia can also burn MOX in its domestic VVERs and it can sell MOX to China for… Read more »

If the contractor was western company, definitely rhetoric would have been different. Objectively Russian offers are unmatched for developing countries. First reason is west lost their big scale nuclear construction capacity, they have nice designs but don’t have implementation ability. Finland – French EPR1750 and US Vogtle AP1000 are proofs. They are expensive, their construction takes decades. At the moment, only reliable nuclear partners are Korea, Russia and China, because they can really built. Among these, Russia has the best financial aid packages. Turkey asked Korea to built NPP with same conditions like Russia but Korea couldn’t. It is hard… Read more »

At El Dabaa- Rosatom Contract is not a build-own-operate (BOO) model, but exactly like ” called the build-operate-transfer (BOT)”