As US nuclear exports decline, experts fear international safeguards will too

By Jessica Lovering, M. Granger Morgan | August 27, 2021

Seabrook Station Nuclear Power Plant as seen from nearby Amesbury, Massachusetts. Credit: ThePessimus. Public domain image accessed via Wikimedia Commons.

Seabrook Station Nuclear Power Plant as seen from nearby Amesbury, Massachusetts. Credit: ThePessimus. Public domain image accessed via Wikimedia Commons.

“China and other countries are closing in fast,” President Biden said in his first speech to Congress earlier this year. “We have to develop and dominate the products and technologies of the future… There is simply no reason the blades for wind turbines can’t be built in Pittsburgh instead of Beijing.” The same argument could be made about commercial nuclear reactors, yet the implications go far beyond pure economic competitiveness.

Over the last decade, think tank reports from the Center for Strategic and International Studies, the Atlantic Council, and the Energy Futures Initiative have sounded alarms; these organizations have argued that declining US commercial nuclear exports are eroding the ability of the United States to play a major role in maintaining adequate international safeguards against the diversion of nuclear materials. Historically, the United States was the dominant exporter of nuclear technology, and those exports came with a lot of safety, security, and nonproliferation strings attached. Now that Russia is and soon China will be the leading exporters of nuclear technologies, a growing number of experts are worried about the international security knock-on effects in these emerging markets.

While it is unlikely that the United States will add significant new nuclear capacity in the next few decades, the international market may. A Third Way and Energy for Growth Hub study projected that global electricity demand would double by 2050, with over 90 percent of that growth coming from outside current high-income countries. Much of that growth is projected to be in countries that are interested in hosting their first nuclear power plant by 2030, according to the Third Way study. In the past, nearly every country that has started a commercial nuclear power program has imported the technology from a big vendor country, and this will likely remain the case moving forward.

Russia and China see this market and are preparing to supply newcomer countries. Most aspiring nuclear newcomer countries already have nuclear cooperation agreements in place with Russia, China, or both—but not with the United States. For example, the Russian state corporation Rosatom is currently constructing two large nuclear power reactors in Bangladesh and three in Turkey.

While revitalizing nuclear power has often been linked to national security, several experts in the national security space have told us that they are skeptical about calls for the United States to regain dominance in the global nuclear market. They suspect that such calls are a stealth attempt to prop up or bail out a failing domestic nuclear sector. They argue that there are more direct pathways for positive US influence in global nuclear security regimes that do not rely on commercial exports. Experts we covened judged two of those pathways—the creation of a US-South Korea consortium to build new power projects and progress on addressing the problem of US domestic nuclear waste—to be both effective at strengthening US influence and feasible policies to implement.

Evaluating strategies to restore US leadership. To sort the rhetoric from the reality and find solutions that strengthen international control of nuclear materials, we convened a 2018 workshop, together with Ahmed Abdulla (then at Carnegie Mellon University, now at Carlton University) and Mike Ford (then at Harvard University, now at Argonne National Laboratory), that brought together experts from the nuclear energy and security fields to work through assumptions about this problem and evaluate potential solutions.

Experts who participated in the workshop agreed that the US commercial nuclear industry has played a significant role in facilitating US leadership in international control regimes. They also believed that, with diminished presence in civilian nuclear power, US influence with respect to these regimes is likely to decline—particularly for the next generation of nuclear technologies.

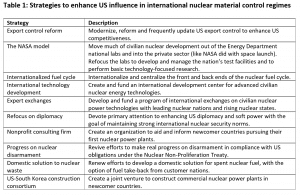

Before the workshop, we identified six strategies that could be adopted to enhance US influence internationally: export control reform, stimulation of the private sector through government procurement (the “NASA model”), an internationalized fuel cycle, international technology development, expert exchanges, and a refocus on diplomacy. (See Table 1.) During the workshop, the experts identified four additional strategies: a nonprofit consulting firm, progress on nuclear disarmament, a domestic solution to nuclear waste, and a US-South Korea construction consortium. (These strategies are also described in Table 1.)

When asked to evaluate the efficacy and feasibility of these strategies over the long term, two emerged as both highly effective and highly feasible to implement: the creation of a US-South Korea consortium to build new power projects and work aimed at making progress on addressing the problem of US domestic nuclear waste. Progress on nuclear disarmament, adoption of a NASA Model, and an internationalized nuclear fuel cycle were deemed highly effective but unlikely to be implemented. The two strategies focused on diplomacy—expert exchanges and a refocus on diplomatic influence—were deemed to be minimally effective in the longterm but easier to implement.

Developing a US-based consulting organization for countries aspiring to build their first nuclear power plant, reforming the nation’s export control system, and building an international technology development center were ranked low in terms of efficacy. The latter two also ranked below the median for feasibility, suggesting that policy makers should think carefully and perhaps make refinements if they pursue development and implementation. Surprisingly, our experts did not agree with the conventional wisdom that US nuclear exports are negatively impacted by overly strict export controls. Simply put, they did not think that US nuclear vendors had or were likely to develop a commercially viable product to sell.

Overall, our group of experts thought that diplomatic strategies would be effective but infeasible during the then-current Trump administration. The Biden administration, with its focus on climate change, diplomacy, and collaboration with our allies, might provide an opportunity to renew US leadership in the global nuclear market.

New opportunities from microreactors. Our security and energy experts agreed that the United States could not compete commercially with large traditional nuclear power plants and was unlikely to compete with small modular reactors. While most of the workshop participants were familiar with the promise of new, so-called advanced nuclear technologies, they were skeptical that these technologies could be commercialized and deployed on relevant timescales for either mitigating climate change or competing in the global nuclear market.

A potentially disruptive nuclear reactor technology—microreactors less than 10 megawatt electric (MWe)—however, is rapidly moving toward commercialization and could have significant security benefits. Due to their small size, microreactors could be commercially available on shorter timescales than even light water small modular reactors. For example, Oklo, Inc. submitted the first combined operating license for a non-light water reactor in March, 2020 for their 1.5 megawatt (MWe) microreactor. In 2019, the Energy Department granted Oklo a site-use permit to build their first plant at the Idaho National Laboratory. In 2016, Canadian Nuclear Laboratories invited small modular reactor developers to submit proposals to build a demonstration reactor at their Chalk River site with the goal of commissioning before 2026. The first applicant to begin formal licensing review happened to be a 5 MWe microreactor.

These microreactor developers aim to deploy first in high-cost, off-grid, micro-grid markets in North America where fuel costs are high. But they could become an attractive export product if proven economical. More importantly, microreactors offer several security and nonproliferation benefits that warrant government support.

Many microreactor concepts include lifetime cores, which means that the reactor is fueled and sealed at a central facility and transported to its operating site where it generates electricity for five to 30 years with no on-site refueling. For refueling or decommissioning, the entire reactor is returned to the central facility. This deployment model would work well with a build-own-operate-remove export model, which allows smaller and less-developed countries access to nuclear power without the need to build domestic fuel handling infrastructure.

To be cost-competitive, many microreactor designs will need to operate with minimal or no staff. Such an operating model will require new regulatory regimes and novel methods of remote monitoring and inspection. This may present implentation challenges at first. Yet developing the technology and instrumentation to perform remote monitoring could facilitate more continuous, robust, and advantageous security monitoring in countries with low regulatory capacities.

What are the policy needs? Microreactors for an export market face significant challenges and policy needs, especially in countries with low institutional capacity to manage nuclear projects. Whether deployed in the United States or abroad, microreactors will likely not be cost competitive if they are licensed on an individual, site-specific basis. US and international regulators will need to develop a licensing process for factory-fabricated, modular designs, similar to commercial aircraft licensing.

Likewise, export agreements should be streamlined and include novel business models with supportive policies from the US government that cover fuel supply, liability, fuel take-back, and financing. Specifically, the build-own-operate-remove export model has never been implemented for nuclear power projects, and industry will need to work with export authorization agencies at the State and Energy Departments to develop these processes.

Finally, while microreactors may offer security and nonproliferation benefits, they will also introduce inspection challenges for the International Atomic Energy Agency. The human resources and skills needed to inspect a single 1 gigawatt reactor are quite different than the resources that will be needed to inspect a large number of 1 MW reactors spread across a country. Remote safety monitoring could expand to include security that could preclude the need for (or reduce the frequency of) in-person inspections.

These challenges are manageable, but they may require more time than most policymakers and regulators realize. The first microreactors will likely be demonstrated in the United States within five years, which means that the United States should develop policies for ensuring safe and secure deployment of this technology now. US government agencies need to be proactive in their engagement with potential host countries. The United States could then share expertise it acquires with international agencies that govern nuclear materials—all while demonstrating renewed leadership and getting ahead of potential problems.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: nuclear energy, nuclear power, nuclear risk, nuclear risk reduction

Topics: Nuclear Energy, Nuclear Risk

Difficult to understand why a business would want to invest in and deploy micro-reactors that are subject to heavy regulation, relatively very expensive, and only able to generate small profits (if any).

I suppose the business model may be based on government handouts, but that strikes me as inherently financially suspect as political administrations come and go.

Micro reactors strike me as a more of grasping-at-straws by some in the nuclear industry.