Should South Korea be Iran’s next nuclear energy partner?

By Duyeon Kim, Ariane Tabatabai | May 31, 2016

Since reaching an historic agreement to scale back its nuclear program last summer, Iran, now liberated from some sanctions, has been actively courting old and new business partners in an effort to revitalize its economy. Among them is South Korea, an already active player in various Iranian sectors. In May, South Korean President Park Geun-hye paid a visit to Tehran, the first by a Korean head of state in 54 years. Accompanied by some 230 business executives, Park reached provisional, multi-billion-dollar deals with Iranian President Hassan Rouhani to boost cooperation in fields including information technology, science, education, and energy; she also met with supreme leader Ayatollah Ali Khamenei, the country’s highest authority figure.

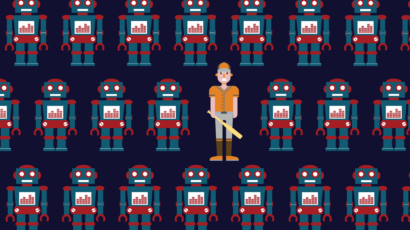

In addition to their established economic and business ties, Iran and South Korea are also beginning to explore potential cooperation in a formerly off-limits sector: nuclear energy. Following the 2015 nuclear deal (the Joint Comprehensive Plan of Action, or JCPOA), Iran is now seeking to expand its peaceful nuclear energy ties with other countries. Meanwhile, advances made by the South Korean nuclear industry, which makes both small modular reactors and large nuclear power plants, have made it an attractive supplier in recent years.

From a nuclear nonproliferation, security, or geopolitical perspective, news about Tehran’s interest in South Korean nuclear reactors may raise eyebrows, eliciting serious concern or objections. This is because, JCPOA notwithstanding, the international community still deems Iran an outlier and a rogue state. And while South Korea is a key US ally in East Asia—one that developed its nuclear energy program thanks to civil nuclear cooperation agreements with Washington—Tehran has a record of noncompliance with its international obligations under the Nuclear Nonproliferation Treaty, and its relations with the United States are characterized by hostility, miscommunication, and distrust. Moreover, Iran has cooperated on missiles and possibly even nuclear projects with North Korea, a country Seoul considers a vital threat to its security. Nonetheless, if we set aside these concerns for a moment, what at first might seem like a ludicrous idea is worth examination and analysis for longer-term policy considerations.

To be sure, there are potential geopolitical and economic challenges and concerns ahead for Iran and South Korea if they choose to become nuclear business partners, and possible downsides to such a relationship. But there are likely upsides, too: Iran—now liberated to build up its nuclear energy industry provided it abides by restrictions in the JCPOA and refrains from weapons development—is going to pursue nuclear power one way or the other. It will have a choice of suppliers, and among them, South Korea has a particularly good track record for high-quality construction, operation, and maintenance. In other words, encouraging Tehran to buy from South Korea—rather than, say, Russia or China—could help establish a strong culture of nuclear safety, nuclear security, and nonproliferation in Iran. If done well, such cooperation may not simply benefit the two countries, but could also help sustain the JCPOA and encourage Iranian compliance with its nuclear commitments even after some of the key elements of the deal conclude in 10 to 15 years.

The competition. It is no surprise that Iran and South Korea would want to rekindle their overall business partnership now that the nuclear deal is being implemented. The two countries have enjoyed a long history of amicable relations since establishing diplomatic ties in 1962. South Korean steel and construction firms were among the first outsiders to help build Iran’s infrastructure in the 1970s. Leaders from South Korea’s emerging industries, in particular the automobile sector, traveled to Tehran in the same time period to exchange ideas with fast-developing Iranian businesses. Hyundai executives would fly to Tehran to meet with Iran’s Paykan, a leading car producer in the Middle East. The South Korean tech and auto sectors have since boomed, while Iran’s collapsed under the weight of mismanagement and sanctions, but the relationship has remained strong. Korean giants like Samsung, LG, Hyundai, and Kia all have a large presence in the Iranian market. A “Tehran Street” exists in Seoul’s business district, while a “Seoul Street” and “Seoul Park” exist in Iran. The fact that South Korea has large investments in Iran may put it in a better position to sell nuclear goods and services to Iran than would-be competitors with little experience in the country.

The competition is significant, though. Russia has had a quasi-monopoly over the Iranian nuclear sector for more than two decades. It is an attractive nuclear supplier for several reasons: It offers a financing package that makes Russian reactors the cheapest in the global market; it is the only country that takes back spent fuel; and it employs a model under which it builds, owns, and operates nuclear plants in the host country—which many would-be buyers deem appealing.

It’s not certain, however, that Moscow’s extremely advantageous marketing strategy is sustainable. This uncertainty is partly due to Russia’s political and economic isolation stemming from its aggressive foreign policy, which has made it the target of sanctions, as well as to its own domestic economic challenges. (Moscow recently announced plans to sell part of its investment in Turkey’s Akkuyu nuclear power plant due to domestic economic difficulties.) While Russia presumably abides by the Nuclear Suppliers Group guidelines when supplying nuclear power reactors, its lack of transparency when it comes to requirements for civil nuclear cooperation projects has led to credibility and confidence questions from many in the international community. Iran also distrusts Russia, which has a history of long construction delays and using energy as a bargaining chip—for example, by threatening to pull the plug on joint projects or withhold equipment and fuel to further its own political goals.

Meanwhile China and Japan, and perhaps even France, are all hoping to gain ground in selling nuclear energy infrastructure to Iran following the JCPOA. China, in particular, is well-positioned to make such gains, as it has a large presence in various sectors of the Iranian economy. However, Tehran does not trust Beijing to use high-quality materials and equipment, and has indicated it is willing to work with other partners. Thus, Iran may see South Korea as the most economical and reliable seller.

Challenges and concerns. In forging a nuclear business relationship with Iran, South Korea would face challenges that go beyond the immediate concerned reaction of nonproliferation and security experts.

First, Seoul would need to consult with Washington prior to moving forward with discussing any commercial nuclear deals with Tehran, since the United States may have political, strategic, and legal objections.

Seoul would also have to consider the political implications of engaging in peaceful nuclear trade with a country that is an intimate business partner with North Korea on ballistic missiles. A concern here would be the possibility of nuclear information and technology clandestinely flowing from Iran into North Korea, despite on-going sanctions, or vice-versa.

But this proliferation risk also shows how important it is—not just for Tehran, but for the rest of the world—for Iran to be able to engage in constructive, civilian nuclear cooperation. New ventures could show Tehran that it is benefiting, not suffering, from the JCPOA, and pinpoint the advantages of remaining in compliance with international obligations. But preventing potential cooperation between Iran and South Korea—or any trusted nuclear exporter—could give Tehran the incentive to turn to suppliers that do not require the same high standards in nuclear safety and security and nonproliferation. Worse yet, Iran could return to noncompliance if it cannot fulfill its nuclear energy needs within the JCPOA framework.

Second, if the notion of South Korea and Iran engaging in peaceful nuclear trade does, in fact, become a reality, Seoul will have to confront the question of whether this commerce is legal. South Korea would not be allowed to sell large nuclear power plants to Tehran without Washington’s approval if they were based on American technology. If South Korea were to sell reactors containing American equipment or technology to Iran, Tehran would have to conclude a nuclear cooperation agreement with the United States, which is unlikely to happen. Seoul would have no legal barriers, however, to selling its small modular reactors—called System-integrated Modular Advanced Reactors—because Seoul claims they do not contain American technology or components. One caveat here is that some have argued otherwise, saying US federal law does not clearly define what constitutes American technology in a nuclear reactor. The broader consideration for Washington would be whether it is more comfortable with Iran pursuing small modular reactors as opposed to conventional, large reactors.

Seoul might also face another roadblock selling its small modular reactors to Iran. South Korea has already agreed to sell them to Saudi Arabia, a much larger market for nuclear energy and Iran’s adversary. Seoul would not want to jeopardize its relationship with Riyadh simply for the sake of diversifying its customer base. Another problem could be a possible mismatch in technical configurations—some industry insiders say South Korea’s small modular reactors do not meet the electricity generation capacity desired by Iran. For these two reasons, the South Korean nuclear industry is said to be discussing the potential sale of large nuclear power plants to Tehran, but this would require US approval. Another consideration may be that while Iran’s nuclear energy market might not be as promising as Saudi Arabia’s, the wider Iranian market could prove to be an important and enticing one for Seoul decision-makers.

Who gains? Should Seoul strategically seize this opportunity to position itself as Tehran’s top nuclear business partner, before China and Russia extend their tentacles deeper into the Iranian market? For some, associating with Iran is simply too taboo. But for anyone whose top priority is to ensure high standards in nuclear safety, nuclear security, and nonproliferation, the answer may be “yes.” This is because South Korea, more than its two most likely competitors, is recognized for its secure procurement channels, for observing strict requirements in the sale of nuclear technology and material, and for safely constructing, operating, and eventually decommissioning reactors.

If Seoul or any trusted nuclear exporter is deemed the supplier of choice, it will be in everyone’s interest—and would calm certain anxieties—for Iran to adopt the highest nuclear safety and security standards. Iran has a long way to go in terms of nuclear safety and security, and working with the world’s best experts would be a step in the right direction. This presents an opportunity to provide educational programs and assistance in these areas. South Korea’s quality manufacturing skills and good track record in construction, operation, and maintenance could promote nuclear safety, security, and nonproliferation. Although the United States is unlikely to enter into a civil nuclear cooperation agreement with Tehran anytime soon, it can indirectly influence Iran through South Korea should plans for cooperation between the two go forward. South Korean efforts to prevent global nuclear terrorism could also open avenues to establish an effective nuclear security culture in Iran.

The United States will view the Iranian nuclear program through the prism of compliance with the JCPOA for the foreseeable future. But while Iran tries to comply, it will also seek to expand its nuclear program. To ensure that the JCPOA is implemented and sustained, it is critical to accommodate both sets of interests. To that end, Iran’s future nuclear partners must bewilling and able to maintain high nuclear nonproliferation, safety, and security standards.

The US will have to consider whether raising objections to nuclear cooperation with a reliable and responsible provider like South Korea will push Tehran toward less desirable partners. If Tehran does turn to a less trustworthy source, it might help achieve Iranian objectives, but it would not be optimal for the United States or the rest of the global community, which has an interest in sustaining the JCPOA and securing compliance from Tehran in the future.

The JCPOA presents a broad window of opportunity. It affords the international community a chance to monitor and control the way the Iranian nuclear program develops for 10 to 15 years. What happens during this time period will determine whether Tehran continues to comply with its international obligations afterwards. If the nuclear deal is implemented properly, Tehran will be much less likely to go back to its previous history of nuclear noncompliance. If the stakeholders miss this chance, all the advantages that stem from the nuclear agreement will be lost. This is why it is worth further studying whether South Korea-Iran civil nuclear cooperation is a step in the right direction for the two countries and global security at large.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Topics: Columnists, Nuclear Energy, Nuclear Weapons