The strategic consequences of ending the arms embargo on Iran

By Farhad Rezaei | August 14, 2020

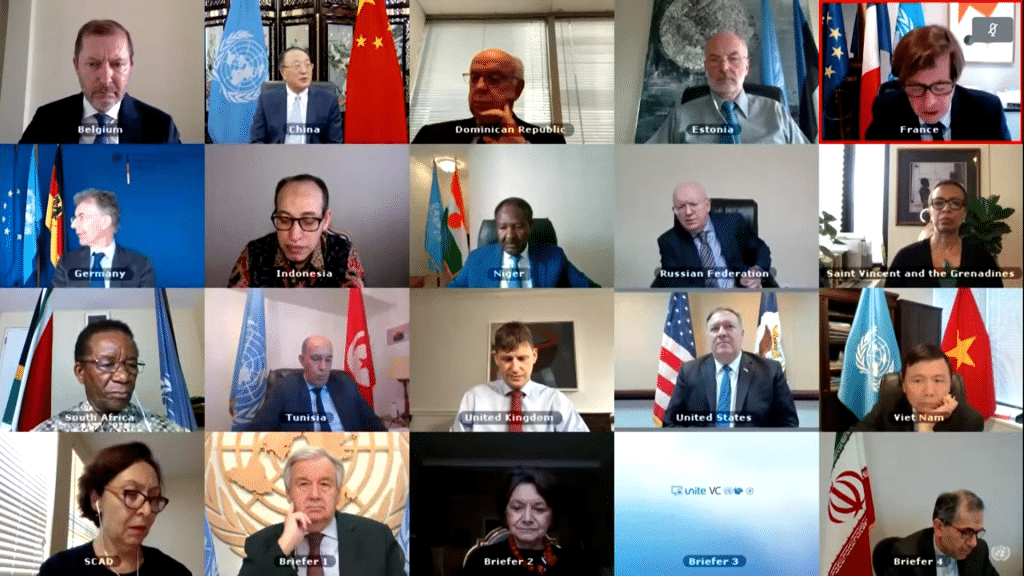

Members of the UN Security Council conducted a virtual meeting on August 13, 2020, to consider a draft resolution to extend the Iran arms embargo.

Members of the UN Security Council conducted a virtual meeting on August 13, 2020, to consider a draft resolution to extend the Iran arms embargo.

In 2015, the UN Security Council passed Resolution 2231, endorsing the nuclear agreement between Iran and the major world powers, officially called the Joint Comprehensive Plan of Action. But the resolution also established a five-year embargo on conventional arms sales going in and out of Iran, replacing earlier resolutions that had levied more permanent restrictions on such sales. Five years on, the moratorium is set to expire on October 18, 2020, although the Trump administration is determined to extend it. If it does expire, Iran will, at least in theory, be allowed to import and export heavy weaponry such as tanks, combat aircraft, and missile systems virtually overnight.

This raises the questions: What are the implications for Iran if the ban is not extended? What are the strategic consequences to United States security and countries in the Middle East? Will Iran rush to rebuild its conventional military arsenal by purchasing new arms, possibly from Russia and China?

To answer these questions, an examination of the current state of Iran’s military capability and strategy is imperative. Iran has made remarkable progress in producing domestic military weapons and hardware, meaning it may not rush to rebuild its conventional military arsenal by purchasing new arms from foreign suppliers. However, Iran will stand to profit from selling its locally produced military equipment to neighboring countries if the embargo expires.

It is important to acknowledge that even if the arms embargo on Iran falls away, the regime will remain under a web of other legal restrictions and sanctions that would likely reduce its ability to import and export conventional weapons. These restrictions and sanctions include the EU arms embargo on Iran, US sanctions on Iran’s banking and financial sector, and the potential threat of secondary sanctions against Chinese or Russian companies that may try to sell arms to Iran, as well as the UN resolutions addressing potential buyers of Iran’s arms like Yemen (through UN Resolution 2216) and Lebanon (through UN Resolution 1701). But, supposing Iran can circumvent these obstacles, what might the consequences of an expired arms embargo be?

Background on Iran’s military strategy. The Islamic Republic of Iran has been under a US arms embargo, distinct from the various multilateral UN embargoes, since the 1979 Islamic Revolution. During the Iran–Iraq war, which began in 1980 and lasted eight years, that embargo limited Iran’s ability to purchase arms with which to defend itself. The conflict also impoverished Iran, limiting its financial ability to create a strong conventional military force. To prevent such a bitter experience from ever happening again, Iran’s post-war military doctrine called for a self-sufficient and radical deterrence posture in order to increase the costs to any would-be aggressor. As a result, today Iran’s deterrence relies on a multi-layered asymmetrical approach consisting of missile systems, irregular naval warfare, and proxy networks that can carry out terror attacks on opponents in the region and beyond.

First, Iran has heavily invested in developing indigenous ballistic missile and missile defense systems to compensate for its limited and obsolete air force assets. Over the years, it has developed what the US Defense Intelligence Agency considers the largest missile arsenal in the region, comprising various types of ballistic and cruise missiles, most of them capable of carrying nuclear warheads.

Iran plans to continue prioritizing the development and acquisition of advanced ballistic missiles, and will continue the transition from liquid to solid propelled systems, which offer greater self-sufficiency—the country has begun producing its own solid fuel for its missiles at its Jajarm Aluminum Production Complex in the northeast. Solid-fuel propellants could also allow the Islamic Revolutionary Guard Corps, a branch of Iran’s armed forces, to bury its missiles in sealed canisters for years without the need for underground bases.

Iran has also started working on developing strategic missile defense capabilities, using diverse launch points and hiding mobile systems, which would allow its army to intercept incoming targets from anywhere. The newest system, called the Khordad-15, is “capable of detecting fighter jets and combat drones from 150 kilometers away and of tracking them within a range of 120 kilometers and is able to detect stealth targets at a distance of 85 kilometers,” according to Iran Defense Minister Brig. Gen. Amir Hatami. The Khordad-15 is credited with shooting down the US RQ-4A Global Hawk surveillance aircraft—one of the most sophisticated drones the United States has—over the Strait of Hormuz in June 2019.

Additionally, the Revolutionary Guard has developed the “Falaq” radar system, a local version of the Russian-made “Gamma” system, and the Bavar-373, an overhauled version of the Russian S-300 surface-to-air missile system. According to Russian military sources, the Bavar-373 “will not only replace the Russian-supplied S-300, but also surpass it.”

Of course, these missile programs constitute only one component of Iran’s air power. The Revolutionary Guards has also devoted a significant portion of military investments to the development of an advanced air industry, manufacturing fighter jets and drones. In fact, Iranian military officials credited their drones with having played a pivotal role in the victory of the Assad regime on the Syrian battleground, and US-based expert Seth Frantzman of the Middle East Center for Reporting and Analysis recently expressed concern that “Iran is becoming a drone superpower.”

The second component of Iran’s strategic doctrine that has received a substantial proportion of military investments is the asymmetrical hybrid naval approach, part of the so-called Anti-Access/Area Denial strategy. The purpose of these investments is to limit American naval operations in the Persian Gulf and beyond, in hopes of being able to disrupt select maritime choke points. In 2012, the Revolutionary Guard, in collaboration with the Imam Hussein University, published a document entitled “Strategic Maritime Triangle, Irregular Maritime Warfare,” outlining the area denial strategy to prevent the US Navy from destroying Iran’s critical targets.

The idea was derived from the lessons of Iran’s efforts to mine the Straits of Hormuz during the “Tanker War” portion of the Iran–Iraq war in 1987. In April 1988, Iranian mines damaged a US Navy ship, resulting in the launch of the American Operation Praying Mantis. That operation destroyed two offshore Iranian oil terminals and several Iranian warships, contributing to Ayatollah Khomeini’s decision to accept the cease-fire with Iraq several months later. Iran’s naval failure, however, spurred the Revolutionary Guard to search for an improved area denial strategy.

Today, the naval branch of the Revolutionary Guard, in conjunction with the regular navy, still employs traditional area denial capabilities, such as land and sea-based anti-ship missiles and sea mines. But it also relies on asymmetrical guerrilla tactics such as the deployment of speed boats for swarming operations, man-operated suicide boats, and drone boats loaded with explosives.

To this end, the Revolutionary Guard has produced various types of submarines as well as military speed boats. Reportedly, it has manufactured over 1,500 of these fast boats, designed to carry out rapid swarming attacks in Persian Gulf waters.

The third component of Iran’s strategic doctrine is to work through proxy networks, which extend to Iraq, Syria, Lebanon, and Yemen. Arguably, the Quds Force, the special Revolutionary Guard unit responsible for extraterritorial operations, has sway over 20 nonstate groups in the Middle East and Africa, including Lebanese Hezbollah, with an estimated 45,000 fighters, and the Iraqi Popular Mobilization Forces, with more than 100,000 fighters.

The proxy network provides Tehran with security benefits, including assistance with countering foreign intelligence threats, intelligence sharing, counterterrorism, and enabling the country to project its power beyond its borders. Furthermore, according to a 2018 Carnegie Endowment report, this strategy has enabled Iran to reduce the number of its combat fatalities in regional wars, particularly on the Syrian battlefield.

Effects of an expiring arms embargo. Because of Iran’s remarkable advances in domestic defense and control systems, it is unlikely that lifting the arms embargo would make a significant difference in how the country maintains its conventional military capability. Most of Iran’s military hardware is locally produced, meaning there is little pressure or demand for major systems.

Moreover, even if the Iranians do rush to purchase conventional weapons from Chinese or Russian suppliers, it would have little overall effect given Iran’s recent history; Iran has not initiated a war with its neighbors in the last 150 years. But it has repeatedly fallen victim to military occupation, referred to by CIA strategists as Iran’s “modern tradition of defeat.” So any new arms procurement would likely be for defensive or deterrent purposes and would be perceived by Iranians as an insurance policy against any potential attack on Iran by its adversaries.

Plus, Iran’s defense budget is a fraction of its regional rivals’. According to the Stockholm International Peace Research Institute, Iran’s defense budget in 2019 was an estimated $12.6 billion. Compare that to the United States defense budget of $732 billion, the Saudi defense budget of $61.9 billion, and the Israeli defense budget of $20.4 billion. Iran’s leaders are well aware that if they begin a buildup of conventional military capacity, the result would be that world powers, including the United States and European countries, would flood the Middle East with more advanced weaponry. Ironically, such a situation could end up restraining Iran, given that other countries are better able to engage in arms competition if the need arises.

It also remains unlikely that arms suppliers—such as Russia and China—would offer sophisticated and offensive weaponry to Iran for combative or defensive purposes, as long as Iran’s rhetoric remains antagonistic toward its neighbors. The history of arms dealing between these countries also suggests that Russia and China will be cautious to sell any arms to Iran that may result in Israel and Saudi Arabia losing their qualitative edge over Iran. After all, China and Russia also maintain good relationships with Jerusalem and Riyadh.

But while an expiring arms embargo might not have much of an effect on Iran’s imports, it is possible that Iran would become a major regional supplier of military hardware through its exports. Iran would stand to profit from selling its domestically produced arms and other military hardware at a much lower price than what other countries are able to offer, including missiles and defense missile systems, tanks, drones, submarines, speed boats, and multi-purpose tactical armored vehicles.

One of the first potential buyers of Iran’s military hardware is likely to be Syria. On July 8, 2020, the two countries signed a defense pact to boost bilateral military cooperation, particularly in the realm of air defense. Likewise, in 2019, Iran offered to build up Iraq’s air defense network, aiming to give Baghdad the capability to counter air strikes from Israel. Iran has also expressed interest in supplying Yemen and Lebanon with defensive weapons as well, although the specific UN resolutions barring such transfers make it highly unlikely that Sana’a and Beirut would be able to import Iranian arms, at least for now.

It is precisely this concern about Iran’s ability to export conventional arms that is partially motivating the United States to try and extend the embargo at the United Nations. But whether such exports would ever amount to much, or substantially change the dynamics of the region, is uncertain. What is certain, though, is that the fate of the arms embargo is inextricably linked with the fate of the 2015 nuclear agreement, and members of the UN Security Council will have to decide which is riskier—allowing Iran to supply its neighbors with arms, or dealing yet another blow to the already enfeebled nuclear deal.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: Iran, Iran nuclear deal, JCPOA, UN Security Council, arms embargo, joint comprehensive plan of action

Topics: Nuclear Risk