Is bitcoin driving a green transformation, or fueling a mirage?

By Maximilian Gill, Jona Stinner, Marcel Tyrell | March 27, 2025

The availability of cheaper surplus energy enables bitcoin miners to deploy more energy and hardware within the same market equilibrium, ultimately increasing overall resource consumption. (Photo: Marko Ahtisaari/Flickr, CC BY 2.0)

The availability of cheaper surplus energy enables bitcoin miners to deploy more energy and hardware within the same market equilibrium, ultimately increasing overall resource consumption. (Photo: Marko Ahtisaari/Flickr, CC BY 2.0)

In recent years, a growing chorus of voices has argued that, far from being environmentally harmful, bitcoin mining could serve as a catalyst for the transition to renewable energy. The magic term here is “surplus energy.” Proponents suggest that excess renewable energy, which might otherwise go to waste, could be harnessed for bitcoin mining. This approach, they argue, could achieve two goals at once: making bitcoin green and promoting the expansion of renewable energy.

These arguments come from various corners. Unsurprisingly, the loudest voices belong to the bitcoin mining lobby, such as the Texas Blockchain Council. However, political figures have also joined the debate. Robert F. Kennedy Jr., the new US Secretary of Health and Human Services, has claimed in The Economist that “a system with more renewable generation and bitcoin miners is far less carbon-intensive than a system with less renewable generation and peaker plants.” In addition to reports from institutions like the World Economic Forum, the consultancy KPMG, and the fintech company Square (now Block), there are also scientists, for example Lal et al. or Velicky, who make similar claims.

But a close look at these bitcoin-is-climate-friendly claims shows they are short-sighted and ill-founded.

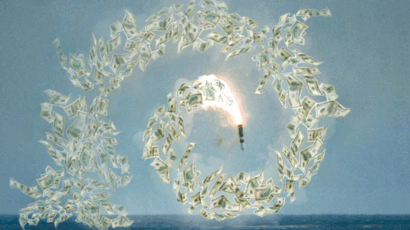

Waste not, want not. Surplus energy occurs when energy production and consumption are out of sync—a common issue with renewable energy, as its generation depends on variable weather conditions like sun and wind. At times, the grid becomes overwhelmed by excess energy, leading to negative electricity prices and financial losses for plant operators. This is where bitcoin mining comes in.

The bitcoin network is a peer-to-peer system, using blockchain technology to facilitate digital transactions without relying on central intermediaries like banks. Bitcoin “mining” refers to the process of validating and executing transactions. Miners compete via the use of brute computational force for the right to add the next block to the blockchain and receive a reward in the form of newly created bitcoin. The probability of receiving this reward is determined by the amount of computational power expended. To maximize potential profits at minimal cost, miners are constantly seeking the cheapest energy sources.

Because bitcoin miners are highly mobile—mining equipment is often delivered in cargo containers—and can ramp up and down their capacities quickly, they are ideally suited to consume surplus energy.

Proponents argue that by buying surplus energy, bitcoin miners can increase the profitability of renewable power plants. These higher returns attract new investments, driving the development of additional renewable energy facilities. They say this helps accelerate the transition away from fossil fuels.

This is an appealing idea but fails to include the broader dynamics of the bitcoin mining market and its role in the green transition.

Market dynamics. The amount of resources—energy and hardware—used by bitcoin miners is determined by their cost relative to potential mining returns. The system-wide total costs of mining tend to equal the mining rewards. As mining rewards increase, mining activity expands accordingly. Currently, block rewards are valued at approximately $40 million daily. If miners collectively spend $30 million on energy and hardware, the remaining $10 million in potential profit will attract additional miners. This influx continues until the profit margin is eroded, and the costs of mining equal the rewards. The exact same thing happens if the cost of mining goes down because miners are taking advantage of cheap surplus energy.

A unit of green surplus energy becoming available does not automatically eliminate a unit of fossil energy from the system. Instead, the availability of cheaper surplus energy enables miners to deploy more energy and hardware within the same market equilibrium, ultimately increasing overall resource consumption.

So while the system’s carbon dioxide emissions may decline due to the use of surplus renewable energy, the overall volume of e-waste increases, as more mining devices are deployed. Paradoxically, an increase in surplus energy availability can even amplify the system’s overall environmental footprint.

Any fossil fuel savings resulting from renewable energy projects that owe their development to bitcoin mining should be celebrated. But there is very little evidence supporting such substitution. Even in Texas—a state experiencing rapid growth in renewable energy that has been a major hub for bitcoin mining since China’s 2021 ban on cryptocurrency mining—there has been no corresponding decline in energy production from non-renewable sources during this period.

Even if we assume that a substitution effect exists and we simply have yet to observe it, two significant challenges remain.

Spatial and temporal mismatch. Renewable energy is often generated in locations far from where it is most needed. One example of this is the Sichuan region in China, where heavy rainfall during the summer months drives abundant hydropower generation, producing more energy than is needed locally. Due to underdeveloped grid infrastructure connecting Sichuan to eastern China, where energy demand is higher, this excess energy results in cheap surplus electricity. Before bitcoin mining was banned, miners were observed relocating to Sichuan during the summer to exploit this cheap surplus energy, only to move back to coal-powered regions afterward. While bitcoin mining provides a temporary economic use for this surplus, it reduces the incentives to invest in grid infrastructure that could make this energy accessible to areas with higher demand, undermining long-term energy efficiency and sustainability.

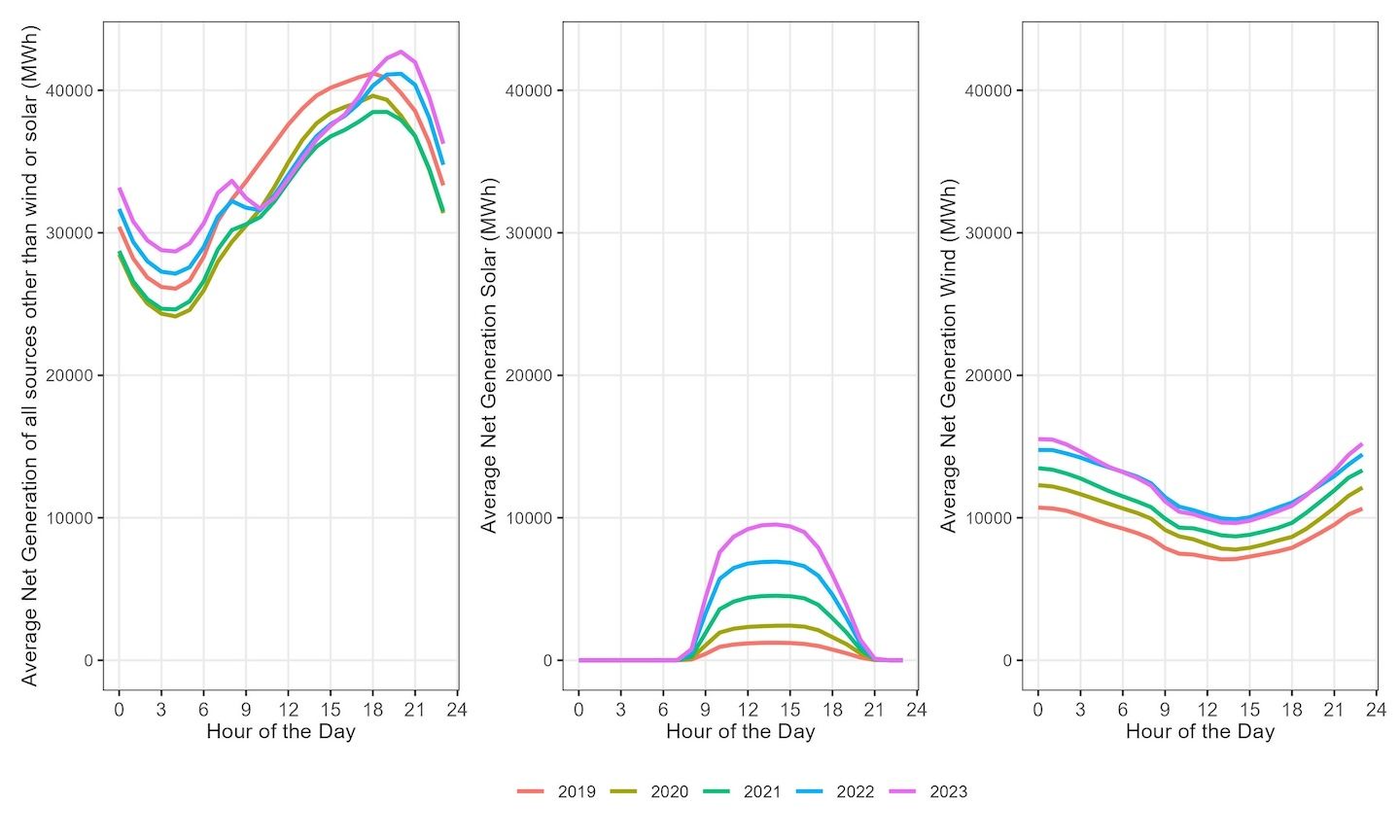

A similar issue has arisen in California. The significant expansion of solar energy in recent years has led to a noticeable decline in the net load—the demand for energy from non-renewable sources—during midday hours. While the net load frequently approaches zero during sunny mid-day hours, there has been no corresponding decrease in fossil fuel demand during the morning, evening, or nighttime hours. Without sufficient investments in energy storage, further expansion of solar energy will not reduce fossil energy use during non-sunny periods.

Bitcoin mining, however, creates counterincentives by offering short-term profits on surplus energy. In the long term, this hinders critical investments in storage and grid infrastructure.

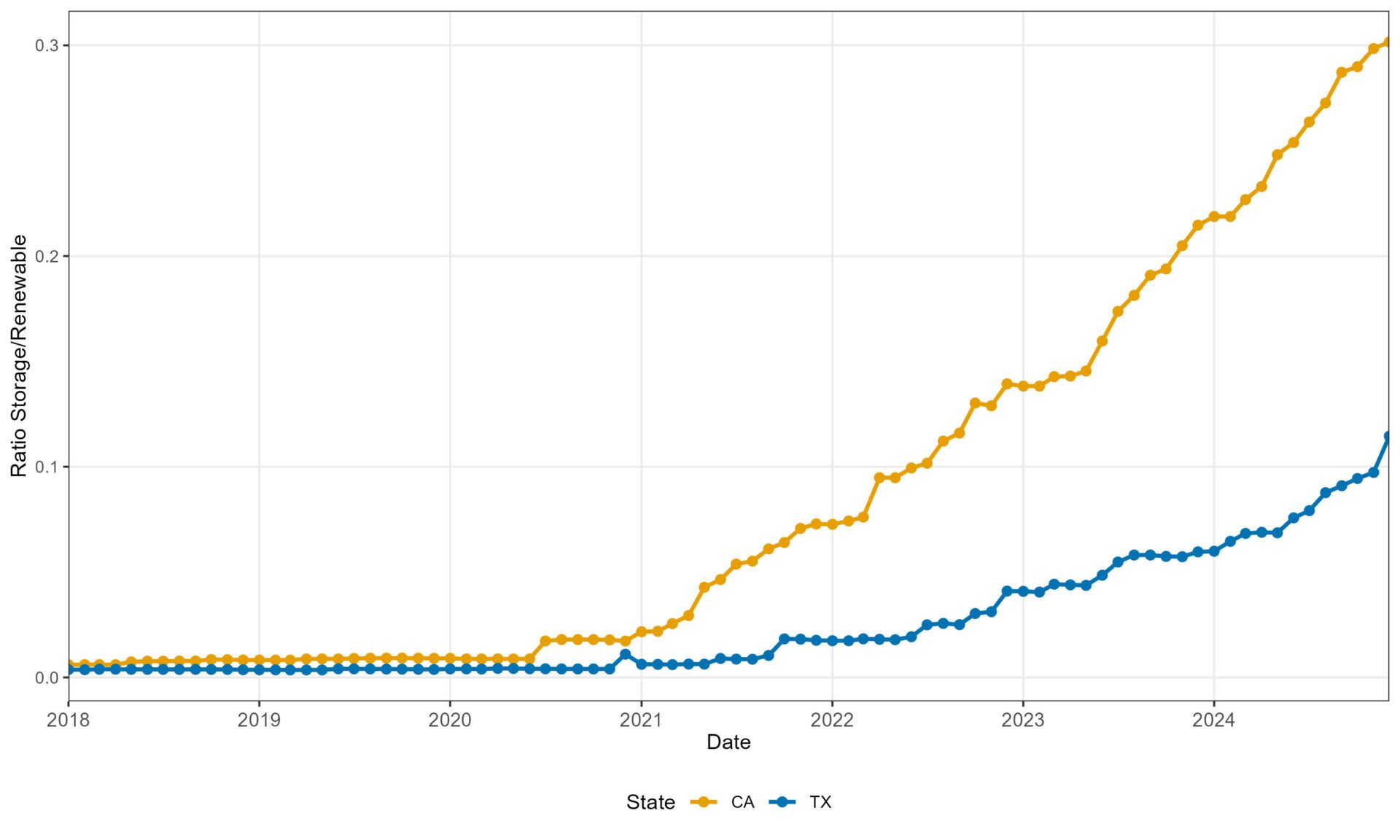

Both California and Texas significantly expanded their renewable energy generation over the last decade, but large-scale bitcoin mining activities took off only in Texas in 2021, while California has no significant mining activity. Although both states had similar levels of storage capacity per unit of renewable energy at the end of 2020, the ratio is now nearly three times higher in California than in Texas.

Governing the ungovernable. Direct national regulation of bitcoin’s environmental impact is largely ineffective. The system’s decentralized nature allows it to circumvent such measures. Even if the United States—currently home to the largest share of bitcoin mining activity—were to take a leading regulatory role, it would not resolve the issue. This is evident from China’s 2021 mining ban, which targeted what was then the world’s largest bitcoin mining hub. Rather than curbing global mining activity, the ban merely triggered a large-scale migration of miners to the United States.

Our research demonstrates that a global pricing mechanism for environmental externalities—addressing carbon-intensive energy consumption and e-waste—could significantly reduce, or even eliminate, bitcoin’s environmental footprint. Crucially, this could be achieved without compromising the system’s functionality or security. A “green bitcoin” is therefore possible, but only if such regulations are adopted on a global scale. However, achieving this level of international coordination remains a distant political prospect.

Still, there are things that could be done: First, regulators should ensure that mining activities are not subsidized in any form. Lowering the costs of mining directly leads to increased resource consumption, exacerbating its environmental impact. Second, they should avoid policies or actions that boost bitcoin’s market capitalization. The approval of bitcoin ETFs, which facilitate capital inflows into the market, should be carefully reconsidered in light of their environmental implications.

To be clear: This critique is not about blockchain itself. There are alternatives to bitcoin’s energy intensive proof-of-work consensus mechanism. The Ethereum blockchain, for example, has demonstrated the viability of switching from proof-of-work to proof-of-stake (an alternative consensus mechanism), reducing its energy consumption by an astonishing 99.988 percent. Differentiating regulation based on the environmental impact of consensus mechanisms could incentivize a transition to less energy-intensive models.

Such regulation in the United States under President Trump is highly unlikely. Trump has consistently expressed skepticism regarding climate change and the necessity of environmental regulation. He has also vowed to make the United States the “crypto capital of the planet,” signed an executive order to “promote US leadership in digital assets,” expressed support for a strategic bitcoin reserve, and launched a meme-coin named after himself.

The proposed “Bitcoin Act,” introduced by Senator Cynthia Lummis in July 2024, aims to establish a US strategic bitcoin reserve by acquiring one million bitcoins over five years. Given bitcoin’s inelastic supply, this initiative would likely inflate bitcoin prices, increasing the resource intensity of mining and bitcoin’s environmental costs.

This makes public discussion and awareness on this issue all the more crucial. The most significant lever is bitcoin’s price, which is driven by the value investors assign to it—a perception largely shaped by public discourse. Therefore, greater awareness of bitcoin’s social costs, particularly its environmental externalities, might influence investment decisions into this cryptocurrency.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: California, Donald Trump, Texas, bitcoin mining, cryptocurrency, energy transition, renewable energy

Topics: Climate Change

Some important context that your article did not mention: The research you cite was contested by the Digital Assets Research Institute last month. https://www.da-ri.org/rebuttal/self-limited-economists. They showed that the paper contained many fundamental flaws, and should not be taken seriously by policymakers or regulators. Further, while your article above mentioned 2 studies, it fails to mention that the growing scientific majority regard Bitcoin mining as aiding decarbonization and UN Sustainability goals. 15 of the last 17 papers on Bitcoin and energy support this thesis. In summary: a single paper in a journal with a low impact factor, that has been contested… Read more »