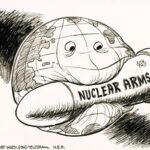

Nuclear aging: Not so graceful

By Mark Cooper | June 18, 2013

The abandonment of aging nuclear reactors—most prominently reactors that need repairs, as is the case at San Onofre in California and Crystal River in Florida, but also at some plants that have simply become uneconomic to operate, like Kewaunee in Wisconsin—has huge implications for resource-acquisition decisions. As the US nuclear fleet ages and the “nuclear renaissance” ballyhooed over the last decade fades into history, having failed to deliver on its promises, these early retirements will be closely scrutinized in regard to decisions about both old and new reactors. The industry is likely to seize on these retirements as justification to get behind the next new nuclear technology, but the lesson they actually teach is quite the opposite. Aging reactors that are too expensive to fix and must be retired before reaching the end of their expected life spans may be not a relic of the past, but an indication of the future. At one time, the nuclear plants now being closed were seen as the future of the electricity-generating industry. They teach a lesson for how the economics of new designs should be evaluated.

Old reactors: Too big to fix. The idea that once nuclear reactors are built, they just hum along, putting out low-cost power with minimum maintenance, is a myth. The life cycle of a nuclear plant is quite complex. While there is a short period of stable, high performance during a reactor’s mature phase, it takes a long period of childhood and adolescent maturation to get to that level, and performance declines as old age sets in. And when they break, nuclear power plants create major problems—not only in the cost of repair, but also in the cost of short-term replacement power.

Because the reactors are so large, utilities lean toward repairing them if at all possible and look for quick fixes. Mid–life-cycle problems at a nuclear plant create an environment for decision making and project implementation that is not unlike the situation that typified the initial US nuclear construction boom in the 1970s.

Stepping back from the details of specific retirement decisions, a pattern can be seen. Parts break as reactors age and need to be repaired. Utilities grab solutions that have not been subjected to full testing and demonstration in the real world—solutions that have a tendency to go bad, as happened at both San Onofre and Crystal River, where efforts to fix an existing problem created even bigger problems. Design changes are made that are not tested in deployment, and significant difficulties result. Uncertainty and escalating costs, coupled with the deteriorating economics of operating inefficient, old reactors, lead to the retirement decision.

Variations on this basic scenario have led to the early retirement of about one-sixth of the nuclear reactors that have been operational in the United States.

Affixing cost responsibility for broken reactors has become a contentious undertaking, creating arguments over whether ratepayers or shareholders should shoulder repair bills. These battles mirror the nasty fights about construction-cost overruns—and who should pay for them—that plagued the early days of the industry.

A perverse-incentive structure makes decision making about major reactor repairs difficult. Because nuclear power plants are so large and costly, they constrain choice. Utilities hesitate to abandon them; generally, the cost of replacement power can be passed along to consumers as nuclear plants are repaired.

While energy experts often stress the need to pursue resource diversity (i.e., not become overly dependent on one resource, like natural gas), the failure of these large nuclear units illustrates why asset diversity—avoiding dependence on individual, large generating facilities—is also important. In some places, where a single reactor constitutes a relatively large part of the resource portfolio, utilities have used threats of early retirement (e.g., at the Vermont Yankee Nuclear Power Station) as a cudgel to extract concessions from ratepayers. The lesson should be to avoid overdependence on a single facility, reducing vulnerability to both economic blackmail and the risk of technology failure.

The early retirement of old, broken reactors like San Onofre and Crystal River could have a positive effect, if those retirements lead to improvements in the decision-making process for all troubled nuclear plants. Late life repair-or-retire decisions need to be subjected to full scrutiny, similar to what takes place in the annual review of a utility’s Integrated Resource Plan, with all options for supplying power considered and realistic assumptions about plant life included. Major repairs to nuclear plants constitute large resource-acquisition decisions, and they need to be treated as such.

The comprehensive, forward-looking nature of the California planning process probably reduced the disruption that could be caused by the retirement decision for San Onofre. In future repair-or-retire assessments, the base-case assumption about the expected life of a reactor—which will also be the period in which repair costs are recovered—should be the original life of the plant license.

In California, Southern California Edison was hoping to restart one of the units at San Onofre, running it at reduced power to reduce wear on damaged steam generators. But the California Public Utilities Commission was moving toward a full-blown regulatory proceeding to vet the repair-retire decision in San Onofre, leading Edison and its partners to decide to close the plant instead.

New reactors: Too expensive to build. Late-life troubles in the life cycle of complex nuclear technologies have implications for decisions relating to new nuclear construction. It took the nuclear industry more than 20 years to get its average load factor up to 90 percent (average load factor being the number of hours a facility is on line producing power each year divided by the total number of hours in a year). For the US fleet, that high average load factor lasted less than a decade. In fact, if one counts the reactors that were retired early and suffered long-term outages, which tend to be excluded in the calculation of load factors, the industry’s average load factor was less than 70 percent. (I analyzed these early retirements and long outages in the July/August 2012 issue of the Bulletin.)

This experience has important implications for future resource decisions. Because new nuclear technologies are extremely complex, one must expect that it will take a significant period of operating experience for a new reactor design to operate consistently at a high level. Decision makers need to use a more realistic—i.e., lower—load factor when considering whether new construction proposals make economic sense.

The current analysis of new nuclear reactor construction proposals tends to assume a long plant life—often up to 60 years. Yet almost one-sixth of US reactors brought on line have been retired before their original 40-year licenses expired. It is unrealistic to assume that complex new technologies will have a significantly better experience.

Load factor and plant life have huge cost implications that must be factored into resource-acquisition decisions. These factors are likely to raise the expected cost of nuclear power because of its complex technology and high capital costs. Energy experts often warn of the uncertainty surrounding natural gas prices, but uncertainties about operating levels and plant life mean that when risk analysis is properly implemented, nuclear power is likely to have much higher risk-adjusted costs than competing sources of electricity.

In the early days of the nuclear renaissance, analysts often varied the assumptions about plant life and load factor to gauge their implications for economic decision making. In subsequent proceedings to secure certificates of need for new nuclear reactors, however, utilities dropped these sensitivity cases and used the most optimistic assumptions. The distortion can be substantial.

In "The Future of Nuclear Power", a 2003 MIT study, and the "Keystone Nuclear Power Joint Fact-Finding", a 2007 report published by the Keystone Center, load factors were varied from 75 percent to 90 percent and plant life from 25 to 40 years. MIT showed that the lower load factor and shorter life increased the cost estimate of a nuclear plant by 20 percent. Keystone showed 30 percent higher costs for the lower load/shorter life scenarios. At today’s increased capital costs, realistic assumptions would yield estimates 60 percent higher than those the utilities have used.

The early retirement of San Onofre provides a reminder about the unique safety concerns of nuclear power. Because the dangers of nuclear power are so great and the technology so complex, safety is an evolving concept that has a larger impact on nuclear power than on other technologies. As reactors age, they fall out of step with current knowledge about safety, and the potential costs of retrofitting them to meet today’s safety standards mount. Economists call this tail risk, and it should be factored into decisions about building new reactors.

The most important ramification of early nuclear plant retirements may be regulatory: They could force regulators to challenge overly optimistic assumptions about complex new technologies, giving more weight to real-world history rather than rosy projections or promises. These early retirements are a reminder that the nuclear “great bandwagon market” of the 1970s and the “nuclear renaissance” of the 2000s both failed to live up to their promises and should provide a strong impetus for healthy skepticism toward the next big thing in nuclear technology.

This skeptical approach should apply to the new darling technology of the nuclear industry, small modular reactors. The public is hearing exactly the same promises about standardization, modularization, learning curve cost reductions, improved safety, and fast construction schedules that were made—and broken—in regard to earlier reactor designs. These are assurances that drive the industry to skip proper research and development and careful pre-commercial demonstration. The early retirements in California, Florida, and elsewhere should lead to greater caution about nuclear power safety and economics, not less.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Topics: Nuclear Energy, Opinion