Highly enriched shareholders mean disasters down the line: Why utilities like TEPCO need new corporate governance

By Julius Weitzdörfer, Denia Djokić | March 11, 2021

Editor’s note: This article is part of a collection of expert commentary on nuclear safety published on the tenth anniversary of the Fukushima disaster, produced in a collaboration between the Project on Managing the Atom at Harvard Kennedy School and the Bulletin.

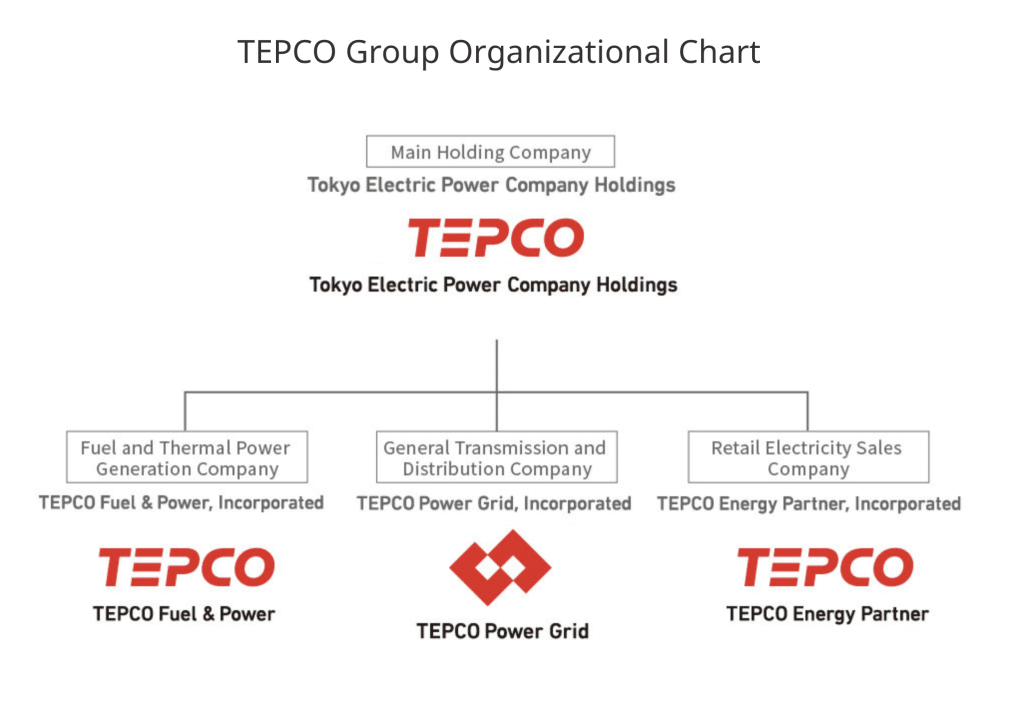

Ten years on, the lessons learned from the Fukushima Dai-ichi Nuclear Power Plant accident continue to focus on improving safety culture and regulatory oversight. However, the executive decisions that failed to prevent the disaster also demonstrate the necessity to re-examine the legal entities most often relied on for producing nuclear power: corporations.

Corporate conflicts of interest. One of the main institutional lessons from the Fukushima accident was that the promotion of nuclear energy and the enforcement of safety measures are best separated on the regulatory level. But there are also good reasons for caution when both responsibilities remain in the same hands on the corporate level. When TEPCO slipped into the red and lost 30 percent of its share value after costly shutdowns elsewhere, its management postponed the planned tsunami protection improvements at Fukushima Dai-ichi. For executives, upgrades beyond regulatory requirements conflict with the obligation to maximize profits to shareholders. Moreover, corporate law not only discourages “unnecessary” investments in safety and security, but can even threaten shareholder derivative suits against them.

Cost cuts and power cuts. If another lesson from Fukushima was that external hazards to nuclear plants must be continually and thoroughly re-evaluated, far-sighted management decisions for back-fittings and modernization are required. Under-addressing the vulnerability of aging infrastructure to natural disasters is not unique to TEPCO. Increasingly frequent extreme weather events, such as recurring wildfires in California or the recent winter storm in Texas, have similarly exposed PG&E, the utility monopoly of Northern California, and ERCOT, the Texas state grid operator, as having catastrophically underinvested in safety and resilience. To avoid the cuts in power that many lives depend on, a changing climate calls on utilities to make long-term infrastructure investments, even though they are costly in the short term.

Shareholder short-termism. The restructurings of TEPCO and PG&E highlight that reactors and their legacies tend to out-live corporations, shareholdings, and executive appointments. Standard executive bonus models tend to offer little in the way of incentives for investments in managing low-probability events or the back end of the life cycle of nuclear reactors. For investors, it is perfectly economically “rational” to vote in favor of cost cuts in annual general meetings, cash their dividends, and dump the shares before long-term costs kick in. In the absence of legislation—and especially for utilities “too big to fail”—it pays off to externalize such burdens on future shareholders, ratepayers, or in case of subsidies and bail-outs, the taxpayer.

More moral hazard. Yet another lesson Fukushima undeniably demonstrated: The financial assets set aside to compensate victims of a real nuclear accident are grossly insufficient. While payouts have so far exceeded $90 billion and are estimated to reach twice as much, all but a handful of national statutory liability ceilings remain two orders of magnitude below the compensation amounts for damages from the Fukushima accident. Nuclear law is intentionally designed to exempt operators from the bulk of liability for accidents (and lets them off the hook entirely from liability for damage caused by terror attacks). Corporate law, in turn, shields shareholders from individual liability. Without changing either of these two systems, the incentive for companies to keep investments near the bare regulatory minimum will persist, and utilities will keep “building reactors on fault lines.”

Smart solutions. Where for-profit utilities are a) tasked with responsibility for inherently risky technologies, while b) maintaining basic services we vitally depend on, and are c) even granted monopolies for this, as in the cases of TEPCO and PG&E, stakes are incomparably higher than with normal companies. Pathways to incentivize public-interest investments in safety and security could include courts re-calibrating the so-called “business judgment rules” against which nuclear executives are held responsible. To provide deterrents, one does not have to threaten criminal sanctions, as in Japan and California. Instead, legislators could raise national nuclear liability caps in cases of gross negligence, or lift the corporate veil protecting shareholders in case of accidents caused by deferred investments in state-of-the-art but non-mandatory upgrades (be they higher tsunami walls, reliable power lines, filtered containment, or defences against drones).

The way forward. To be fair, TEPCO had a large proportion of long-term shareholders that made it unlike other investor-owned utilities. And public ownership of nuclear utilities does not come without its challenges either. But it is less prone to the “take the money and run” and “private-profit public-risk” temptations epitomized by corporate catastrophes: bankruptcies and bail-outs with TEPCO in the case of Fukushima Dai-ichi and PG&E in the case of the California wildfires. Off-the-shelf corporate governance, state-of-the-art cost-efficiency, standard discount rates, and textbook risk-benefit decisions are not what it takes to ensure safe, secure, and reliable nuclear energy. Policymakers around the world are well-advised to realize that these domains lie beyond the reach of technology-based regulators, and indeed of nuclear law, and might be best addressed on another level, in another silo: corporate law.

As we continue to learn from the intertwined social, technical, political, and economic factors of the Fukushima disaster, we must, at minimum, re-design and modernize corporate governance and incentive structures, just as we do with reactors and regulatory bodies. In the face of natural disasters, increasingly frequent extreme weather events, and novel security threats, it has never been clearer that conventional corporate incentives do not lead to the prioritization of human and environmental health and safety over short-term interests.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: conflict of interest, corporate governance, fukushima10, moral hazard, nuclear accidents

Topics: Nuclear Energy, Nuclear Risk

Here in the USA, the NRC is a captured agency and in many states the utilities give donations to legislators and have an army of lobbyists.

Industry/utility gets the funding and legislation they desire.

The game is rigged.