Chinese nuclear weapons, 2024

By Hans M. Kristensen, Matt Korda, Eliana Johns, Mackenzie Knight | January 15, 2024

Chinese nuclear weapons, 2024

By Hans M. Kristensen, Matt Korda, Eliana Johns, Mackenzie Knight | January 15, 2024

The modernization of China’s nuclear arsenal has both accelerated and expanded in recent years. In this issue of the Nuclear Notebook, we estimate that China now possesses roughly 500 nuclear warheads, with more in production to arm future delivery systems. China is now believed to have one of the fastest-growing nuclear arsenals among the nine nuclear-armed states. The Nuclear Notebook is researched and written by the staff of the Federation of American Scientists’ Nuclear Information Project: director Hans M. Kristensen, senior research fellow Matt Korda, research associate Eliana Johns, and Herbert Scoville Jr. peace fellow Mackenzie Knight.

This article is freely available in PDF format in the Bulletin of the Atomic Scientists’ digital magazine (published by Taylor & Francis) at this link. To cite this article, please use the following citation, adapted to the appropriate citation style: Hans M. Kristensen, Matt Korda, Eliana Johns, and Mackenzie Knight, Chinese Nuclear Weapons, 2024, Bulletin of the Atomic Scientists, 80:1, 49-72, DOI: https://doi.org/10.1080/00963402.2023.2295206

To see all previous Nuclear Notebook columns in the Bulletin of the Atomic Scientists dating back to 1987, go to https://thebulletin.org/nuclear-notebook/.

Within the past five years, China has significantly expanded its ongoing nuclear modernization program by fielding more types and greater numbers of nuclear weapons than ever before. Since our previous edition on China in March 2023, China has continued to develop its three new missile silo fields for solid-fuel intercontinental ballistic missiles (ICBMs), expanded the construction of new silos for its liquid-fuel DF-5 ICBMs, has been developing new variants of ICBMs and advanced strategic delivery systems, and has likely produced excess warheads for eventual upload onto these systems once they are deployed. China has also further expanded its dual-capable DF-26 intermediate-range ballistic missile force, which appears to have completely replaced the medium-range DF-21 in the nuclear role. At sea, China has been refitting its Type 094 ballistic missile submarines with the longer-range JL-3 submarine-launched ballistic missile. In addition, China has recently reassigned an operational nuclear mission to its bombers and is developing an air-launched ballistic missile that might have nuclear capability. In all, China’s nuclear expansion is among the largest and most rapid modernization campaigns of the nine nuclear-armed states.

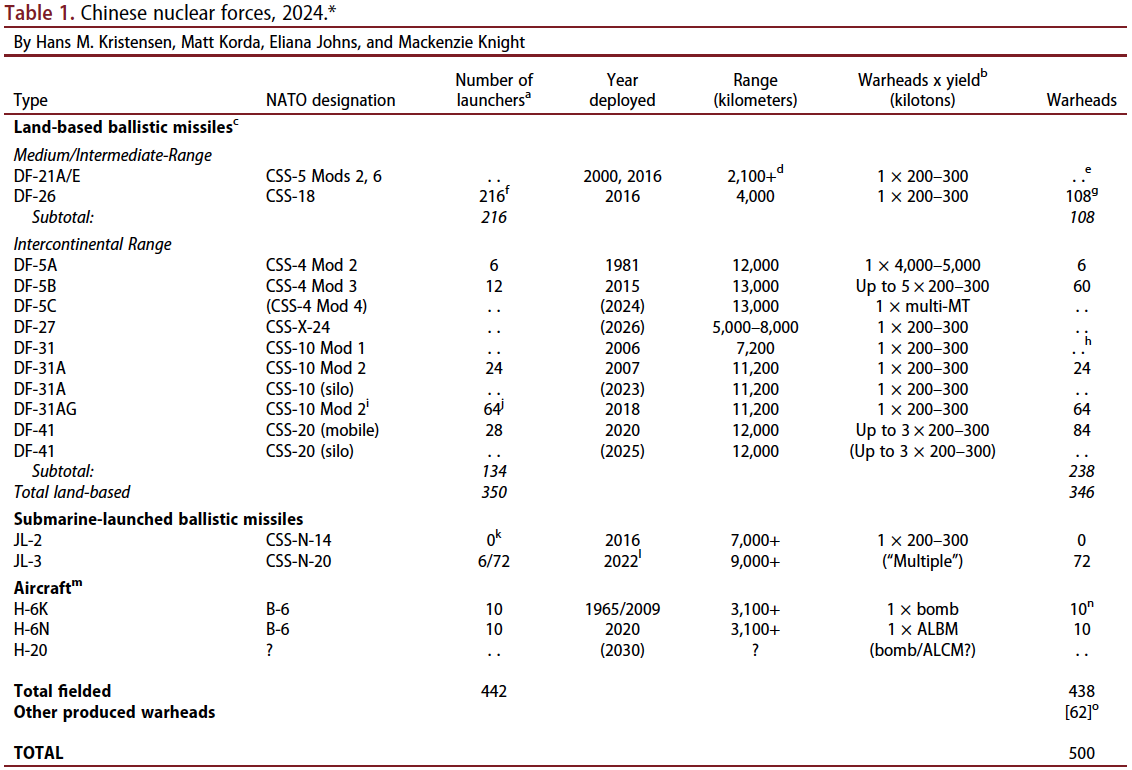

We estimate that China has produced a stockpile of approximately 440 nuclear warheads for delivery by land-based ballistic missiles, sea-based ballistic missiles, and bombers. Roughly 60 more warheads have thought to have been produced, with more in production, to eventually arm additional road-mobile and silo-based missiles and bombers (see Table 1).

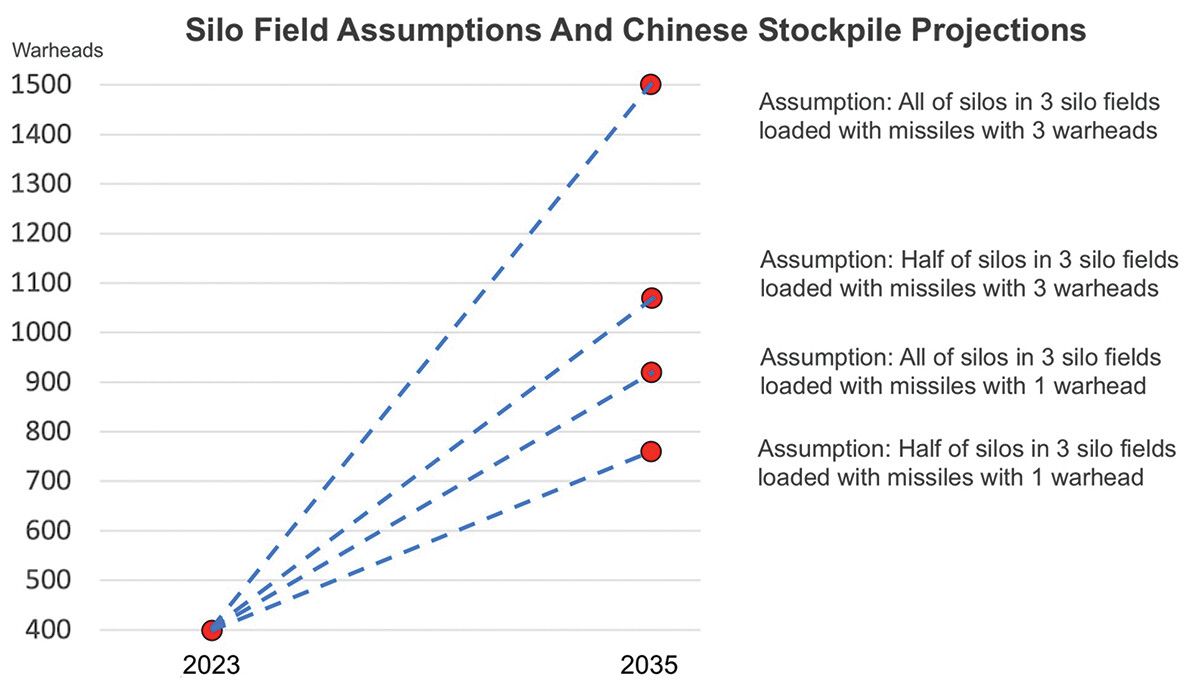

The Pentagon’s 2023 report to Congress assessed that China’s nuclear stockpile now includes over 500 warheads, in accordance with our own estimate. The Pentagon also estimates that China’s arsenal will increase to about 1,000 warheads by 2030, many of which will probably be “deployed at higher readiness levels” and most “fielded on systems capable of ranging the [continental United States]” (US Department of Defense 2023, viii, 111). If expansion continues at the current rate, the Pentagon’s previous projections say that China might field a stockpile of about 1,500 nuclear warheads by 2035 (US Department of Defense 2022b, 94, 98).

These projections depend on many uncertain factors, including:

- How many missile silos China will ultimately build;

- How many silos China will load with missiles;

- How many warheads each missile will carry;

- How many DF-26 intermediate-range ballistic missiles will be deployed and how many of them will have a nuclear mission;

- How many missile submarines China will field and how many warheads each missile will carry;

- How many bombers China will operate and how many weapons each will carry; and

- Assumptions about the future production of fissile materials by China.

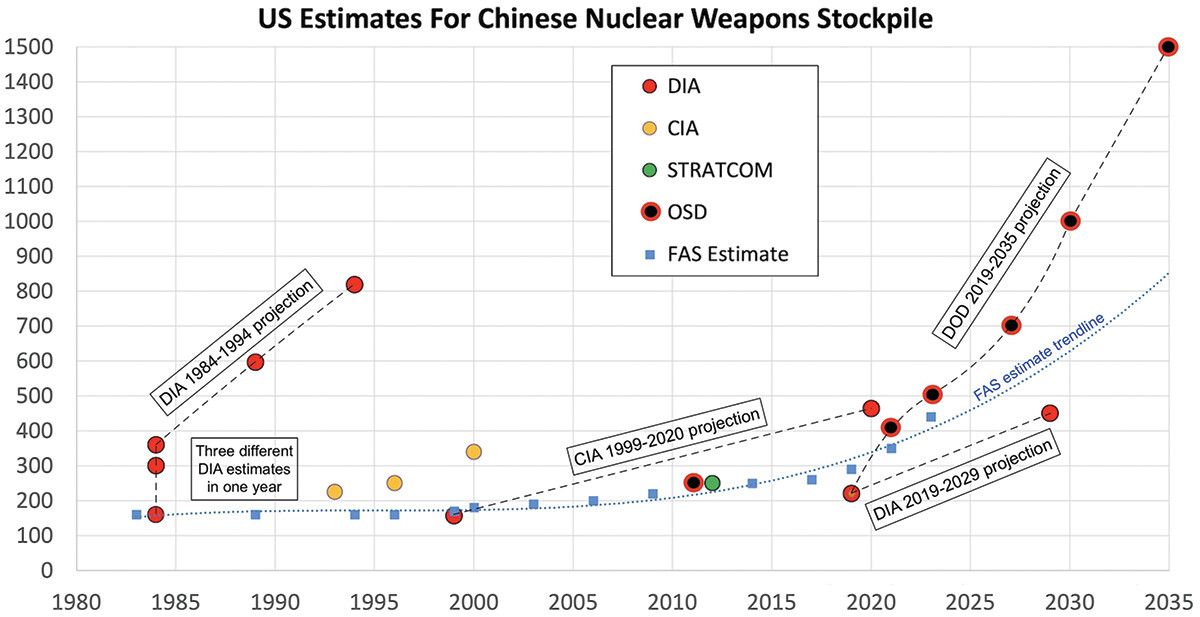

Several US government estimates about China’s nuclear weapons stockpile growth have previously proven inaccurate. The latest Pentagon projection appears to simply apply the same growth rate of new warheads added to the stockpile between 2019 and 2021 to the subsequent years until 2035. We assess that this projected growth trajectory is feasible but depends significantly upon answers to the above questions (Figure 1).

Research methodology and confidence

The analyses and estimates made in the Nuclear Notebook are derived from a combination of open sources: (1) state-originating data (e.g. government statements, declassified documents, budgetary information, military parades, and treaty disclosure data); (2) non-state-originating data (e.g. media reports, think tank analyses, and industry publications); and (3) commercial satellite imagery. Because each of these sources provides different and limited information that is subject to varying degrees of uncertainty, we crosscheck each data point by using multiple sources and supplementing them with private conversations with officials whenever possible.

Analyzing and estimating China’s nuclear forces is a challenging endeavor, particularly given the relative lack of state-originating data and the tight control of messaging surrounding the country’s nuclear arsenal and doctrine. Like most other nuclear-armed states, China has never publicly disclosed the size of its nuclear arsenal or much of the infrastructure that supports it. This degree of relative opacity makes China’s nuclear arsenal difficult to quantify, particularly given that it is likely the fastest-growing arsenal in the world. China may become more transparent about its nuclear forces over the coming decade if it deepens its participation in arms control consultations—the first of which took place in November 2023—although building a culture of nuclear transparency from scratch will take time (Gordon 2023).

Despite these blind spots, it is possible to develop a much more comprehensive picture of the Chinese nuclear arsenal today than just a few decades ago by examining videos of China’s People’s Liberation Army (PLA), military parades, translations of strategic documents, and commercial satellite imagery. The relative degree of structure and standardization within the various PLA services also allows researchers to better understand the structure and mission of missile brigades and individual units. For example, China’s missile designations generally indicate the number of stages that the missile contains (e.g., the DF-26 is a two-stage missile, while the DF-31 is a three-stage missile), and each PLA unit’s five-digit military unit cover designation offers clues as to where the unit is located, how large it is, and its base and brigade assignment (Eveleth 2023, 7, 26; Xiu 2022, 6–7).

In addition, other countries—particularly the United States—regularly produce public assessments or statements about China’s nuclear forces. Such statements, however, must be verified as they can be institutionally biased and reflect a mind-set of worst-case thinking rather than the most-likely scenario. Analysis produced by think tanks and non-governmental experts can also be highly useful in informing estimates: The transparency surrounding China’s missile forces in particular has been greatly enhanced in recent years by the unique work of Decker Eveleth (Eveleth 2023), Ben Reuter, and the US Air Force’s China Aerospace Studies Institute.

It is important to view external analysis with a critical eye, as there is a high risk of citation and confirmation bias, in which governmental or non-governmental reports build on each other’s estimates—sometimes without the reader knowing that this is occurring. This practice can inadvertently create a cyclical echo chamber effect, which may not necessarily match the reality on the ground.

In the absence of reliable or official data, commercial satellite imagery has become a particularly critical resource for analyzing China’s nuclear forces. Satellite imagery makes it possible to identify air, missile, and navy bases, as well as potential underground storage facilities. For instance, satellite imagery was used by non-governmental experts, including some of the authors of this report, to document China’s new missile silo fields in 2021 (Korda and Kristensen 2021), and has been instrumental for continuously monitoring construction at those sites and at other bases across the country. The PLA’s standardization has also enabled researchers to better understand developments at China’s military bases, as layouts and construction dynamics now increasingly follow the same patterns, designs, and dimensions.

Considering all these factors, we maintain a relatively higher degree of confidence in our Chinese nuclear force estimates than in those of other nuclear-armed countries where official and unofficial information is scarce (Pakistan, India, Israel, and North Korea). However, our estimates about Chinese nuclear forces come with relatively more uncertainty than those for countries with greater nuclear transparency (the United States, the United Kingdom, France, and Russia).

Fissile materials production

How much and how fast China’s stockpile can grow will depend upon its inventories of plutonium, highly enriched uranium (HEU), and tritium. The International Panel on Fissile Materials assessed that at the end of 2022, China had a stockpile of approximately 14 tonnes (metric tons) of HEU and approximately 2.9 tonnes of separated plutonium in or available for nuclear weapons (Kütt, Mian, and Podvig 2023, 328–329). The existing inventories were sufficient to support a doubling of the stockpile over the past five years. However, producing more than 1,000 additional warheads by 2035, as estimated by the Pentagon, would require additional fissile material production. The Pentagon assesses that China is expanding and diversifying its capability to produce tritium (US Department of Defense 2023, 110). In 2023, China also reportedly began operating two large new centrifuge enrichment plants, and also took a significant step forward with its domestic plutonium production capabilities (Zhang 2023a, 2023b).

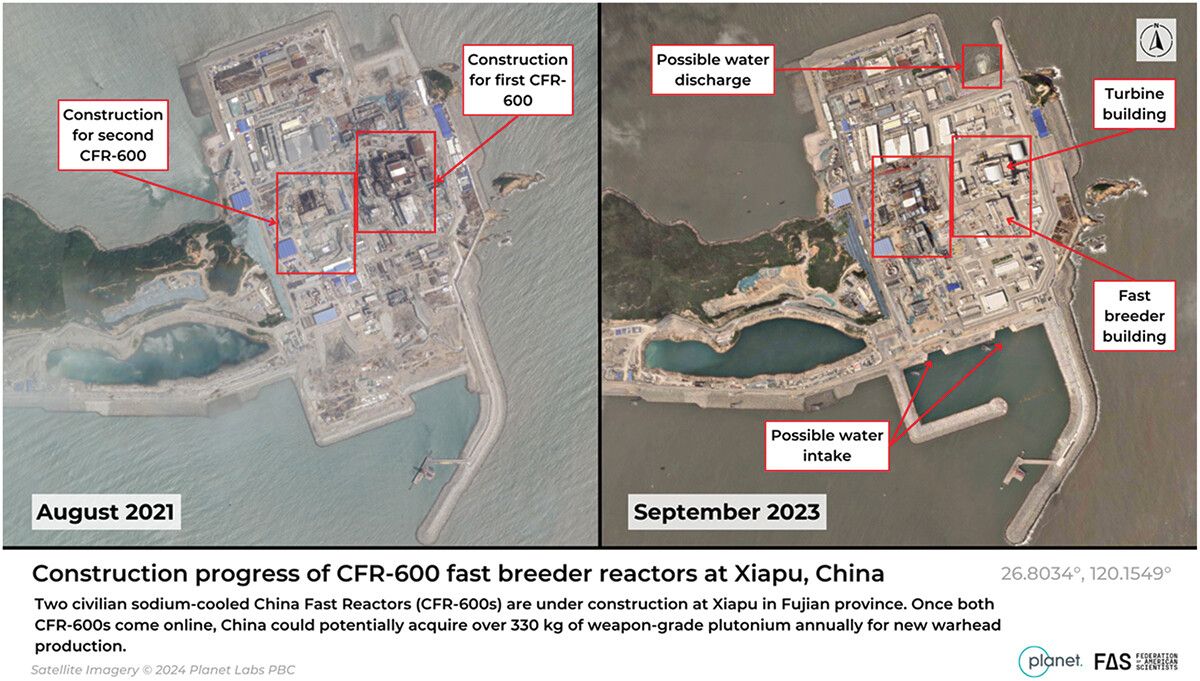

Chinese production of weapon-grade plutonium reportedly ceased in the mid-1980s (Zhang 2018). However, Beijing is combining its civilian technology and industrial sector with its defense industrial base to leverage dual-use infrastructure (US Department of Defense 2023, 28). It is believed that China likely intends to acquire significant stocks of plutonium by using its civilian reactors, including two commercial-sized CFR-600 sodium-cooled fast-breeder reactors that are currently under construction at Xiapu in Fujian province (Jones 2021; von Hippel 2021; Zhang 2021b). Rosatom—Russia’s state-controlled nuclear energy company—completed the final delivery of fuel to supply the first fuel loading in December 2022 (Rosatom 2022), and steam possibly seen emanating from a cooling tower on satellite imagery in October 2023 suggests the first CFR-600 reactor may have begun operation (Kobayashi 2023). In December 2023, the International Panel on Fissile Materials reported that the first reactor reportedly began operating at low-power mode in mid-2023, although as of October 2023 it had not yet been connected to the grid and had not yet begun generating electricity (Zhang 2023a). The second reactor is scheduled to come online by 2026 (Figure 2).

To extract plutonium from its spent nuclear fuel, China has nearly completed its first civilian “demonstration” reprocessing plant at the China National Nuclear Corporation (CNNC) Gansu Nuclear Technology Industrial Park in Jinta, Gansu province, which is expected to be operational in 2025. China has started the construction of a second plant at the same location, which should be up and running before the end of the decade (Zhang 2021a). The 200 tonne-per-year fuel reprocessing capacity at Jinta and the 50 tonne-per-year capacity at Jiuquan (Plant 404) could support the plutonium needs of the two CFR-600 reactors, especially since the first of these reactors will begin operation with highly enriched uranium (HEU) rather than mixed oxide (MOX) fuel through a supply agreement with Russia (US Department of Defense 2023, 109; Zhang 2021a).

The ambiguity of Chinese nuclear warhead types and uncertainty on the exact amount of fissile material required for each warhead design make it difficult to estimate how many weapons China could produce from its existing HEU and weapons-grade plutonium stockpiles. Once both fast-breeder reactors come online, they could potentially produce large amounts of plutonium and, by some estimates, could enable China to acquire over 330 kilograms of weapon-grade plutonium annually for new warhead production (Kobayashi 2023)—which would be consistent with the Pentagon’s most recent projections.

While China’s production and reprocessing of fissile materials is consistent with its nuclear power efforts and its goal of reaching a closed nuclear fuel cycle, the Pentagon suggests that “it is likely that Beijing intends to use this infrastructure to produce nuclear warhead materials for its military in the near term” (US Department of Defense 2023, 109). The degree of transparency surrounding China’s nuclear materials production and its suspected expansion of uranium and tritium production has recently decreased as China has not reported its separated plutonium stockpile to the International Atomic Energy Agency since 2017.

US estimates and assumptions about Chinese nuclear forces

Evaluation of current US projections about the future size of China’s nuclear weapons stockpile must take earlier projections into account, some of which did not come to pass. During the 1980s and 1990s, US government agencies published several projections for the number of Chinese nuclear warheads. A US Defense Intelligence Agency study from 1984 inaccurately estimated that China had 150 to 360 nuclear warheads and projected it could increase to more than 800 by 1994 (Kristensen 2006). Over a decade later, another Defense Intelligence Agency study published in 1999 projected that China might have over 460 nuclear weapons by 2020 (US Defense Intelligence Agency 1999). While this latter projection ultimately proved to be closer to the warhead estimate the Pentagon published in 2020, it was still more than twice the “low-200s” warhead estimate announced by the Pentagon (US Department of Defense 2020a, ix; Figure 3).

Current US projections should be read with this record in mind. In November 2021, the Pentagon’s annual China Military Power Report (CMPR) to Congress projected that China could have 700 deliverable warheads by 2027, and possibly as many as 1,000 by 2030 (US Department of Defense 2021, 90). The 2022 Pentagon report increased the projection even further, claiming that China’s stockpile of “operational” nuclear warheads had surpassed 400 and will likely reach about 1,500 warheads by 2035 (US Department of Defense 2022b, 94). According to the latest 2023 CMPR, China “had more than 500 operational nuclear warheads” as of May 2023 and is on track to have over 1,000 operational warheads by 2030 as previously reported (US Department of Defense 2023, viii). The observable operational force structure, however, does not add up to more than 500 operational warheads (this report estimates approximately 440) unless the Pentagon estimate attributes nuclear warheads to all the DF-26 launchers (which seems excessive), several dozen new missile silos have been loaded with missiles (which is possible, but we have not yet seen indications of widespread loading operations with commercial satellite imagery), or the estimate includes new warheads in production for new missiles. To that effect, this report estimates that China’s stockpile numbers approximately 500 warheads; however, we assess that several dozen of these have not yet been fielded and have likely been produced (or are in production) to eventually arm incoming delivery systems. Curiously, the 2023 report does not repeat the 1,500-warhead projection for 2035.

After the release of the 2022 CMPR, the spokesperson for China’s Ministry of National Defense, Senior Col. Tan Kefei, reacted saying that the Pentagon was “distorting China’s national defense policy and military strategy, groundlessly speculating about China’s military development” (Li 2022a). The following year, spokesperson Wu Qian criticized the 2023 CMPR, saying it “exaggerated and sensationalized the non-existent ‘Chinese military threat’” (Ministry of National Defense of the People’s Republic of China 2023a). None of the two spokespersons acknowledged—nor denied—the expansion of the mobile ICBM force or the construction of three large new missile silo fields.

The projected increase has unsurprisingly triggered a wide range of speculations about China’s nuclear intentions. In 2020, Trump administration officials suggested that “China no longer intends to field a minimal deterrent,” and instead strives for “a form of nuclear parity with the United States and Russia” (Billingslea 2020). These statements were echoed in August 2021 by the Deputy Commander of US Strategic Command, who stated that: “There’s going to be a point, a crossover point, where the number of threats presented by China will exceed the number of threats that currently Russia presents,” noting that this point would likely be reached “in the next few years” (Bussiere 2021). In April 2022, the commander of the US Strategic Command, Adm. Charles Richard, referred to China’s expansion of its strategic and nuclear forces as “breathtaking,” later stating that China was intent on pursuing a “world-class military by 2030, and the military capabilities to seize Taiwan by force, if they choose to, by 2027” (US Strategic Command 2022). He also referred to China’s “investments in nuclear command and control” and “nascent launch under warning, launch under attack” capabilities as clear signs that they have improved their readiness and “moved a long way off the historic minimum-deterrence posture” (US Strategic Command 2022). In March 2023, the Commander of the US Strategic Command (STRATCOM), Gen. Anthony Cotton, conveyed a similar perspective, testifying that “China seeks to match, or in some areas surpass, quantitative and qualitative parity with the United States in terms of nuclear weapons. China’s nuclear capabilities already exceed those needed for its long-professed policy of ‘minimum deterrence,’ but China’s capabilities continue to grow at an alarming rate” (Cotton 2023).

Even the worst-case projection of 1,500 warheads by 2035 amounts to less than half of the current US nuclear stockpile, so the Chinese government uses the disparity in total warhead numbers to argue it is “unrealistic to expect China to join [the United States and Russia] in a negotiation aimed at nuclear arms reduction” (Ministry of National Defense of the People’s Republic of China 2020). While highlighting the increase of Chinese warheads, US defense officials at the same time downplay the importance of numbers when reminded that the United States has many more: “We don’t approach it from purely a numbers game,” according to the deputy commander of the US Strategic Command, Lt. Gen. Thomas Bussiere. “It is what is operationally fielded, … status of forces, posture of those fielded forces. So, it is not just a stockpile number,” he said (Bussiere 2021).

Nuclear testing

The projection for how much the Chinese nuclear stockpile will increase also depends on the size and design of its warheads. China’s nuclear testing program of the 1990s partially supported development of the warhead type currently arming the DF-31-class ICBMs. This warhead may also have been used to equip the liquid-fueled DF-5B ICBM with multiple independently targeted reentry vehicle (MIRV) technology, replacing the much larger warhead used on the DF-5A. The large DF-41 and the JL-3 could potentially use the same smaller warhead. The Pentagon believes that China probably seeks a “lower-yield” nuclear warhead for the DF-26 (US Department of Defense 2023, 111), however it is unclear if that implies production of a new warhead or how low a “lower” yield is; the warhead for the DF-31 and DF-41 are also thought to have lower yield than the warhead deployed on the DF-5A.

Recently, the United States has publicly shared its concerns about activity at China’s Lop Nur nuclear test site. The (US Department of State’s 2022) Compliance Report assessed that some of China’s actions at Lop Nur “raise concern” about China’s adherence to the United States’ “zero-yield” standard (US Department of State 2022, 29). However, the report did not explicitly accuse China of conducting tests that produced a yield, nor did it present any evidence to that effect. The 2023 Compliance Report provided no update on China’s activity at Lop Nur, and the 2023 China Military Posture Report implied again that China is possibly preparing to operate its Lop Nur test site “year-round,” but offered no new information (US Department of State 2023, 18; US Department of Defense 2023, US Department of Defense 2022b, 98).

Open-source satellite imagery analysis indicates that China appears to be expanding the Lop Nur test site with the construction of approximately a dozen concrete buildings near the site’s airfield, as well as at least one new tunnel at the site’s northern testing area (Brumfiel 2021b). Satellite imagery shows what appears to be new drainage areas, drill rigs, roads, spoil piles, and covered entrances to potential underground facilities, as well as new construction at the main administration, support, and storage areas (Brumfiel 2021a; Babiarz 2023; Lewis 2023). Many of these activities remained visible as of the time of writing this report. In addition to new activity at the northern tunnel test area, satellite imagery also indicated activity at a possible new eastern test area at Lop Nur (Babiarz 2023). Although the construction works are significant, they do not necessarily prove that China plans to conduct new nuclear detonations at the test site. If China did conduct low-yield nuclear tests at Lop Nur, it would violate its responsibility under the Comprehensive Test Ban Treaty it has signed but not ratified.

Nuclear doctrine and policy

Since its first nuclear test in 1964, China has maintained a consistent narrative about the purpose of its nuclear weapons. This narrative was recently restated in China’s updated 2023 national defense policy: “China is always committed to a nuclear policy of no first use of nuclear weapons at any time and under any circumstances, and not using or threatening to use nuclear weapons against non-nuclear-weapon states or nuclear-weapon-free zones unconditionally. … China does not engage in any nuclear arms race with any other country and keeps its nuclear capabilities at the minimum level required for national security. China pursues a nuclear strategy of self-defense, the goal of which is to maintain national strategic security by deterring other countries from using or threatening to use nuclear weapons against China” (Ministry of National Defense of the People’s Republic of China 2023b).

Despite its declaratory policy of emphasizing a “defensive” nuclear posture, China has never defined how large a “minimum” capability is or what activities constitute an “arms race,” and the stated policies evidently do not prohibit a massive expansion. The posture apparently seeks to “adapt to the development of the world’s strategic situation,” part of which involves the “organic integration nuclear counterattack capability and conventional strike capability” (China Aerospace Studies Institute 2022, 381–382).

Such capabilities require investing significant resources to ensure the survivability of the nuclear arsenal against a nuclear or conventional first strike, including practicing “nuclear attack survival exercises” to ensure that troops could still launch nuclear counterattacks if China were to be attacked (Global Times 2020). It also involves improving space-based early warning systems and the stealth capabilities of its nuclear forces to be able to elude enemy detection (Kaufman and Waidelich 2023, 42, 45).

The People’s Liberation Army (China’s principal military force) maintains what it refers to as a “moderate” readiness level for its nuclear forces and keeps most of its warheads at its regional storage facilities and its central hardened storage facility in the Qinling mountain range.[1] The 2023 Pentagon report reaffirmed this posture, stating that China maintains “a portion of its units on a heightened state of readiness while leaving the other portion in peacetime status with separated launchers, missiles, and warheads.” But the report also described that the People’s Liberation Army Rocket Force (PLARF) brigades conduct “combat readiness duty” and “high alert duty” drills, which “includes assigning a missile battalion to be ready to rapidly launch” (US Department of Defense 2023, 106).

The readiness of the Chinese nuclear missile force was challenged in early 2024 with disclosure that a US intelligence assessment had found that corruption within the People’s Liberation Army had led to an erosion of confidence in its overall capabilities, particularly when it comes to the Rocket Force (Martin and Jacobs 2024).

Increased readiness and alert drills do not necessarily require nuclear warheads to be installed on the missiles or prove that they are installed at all times, but it cannot be ruled out either. However, recent dismissals of top defense officials and widespread corruption might chill the Chinese leadership’s willingness to arm missiles with warheads in peacetime. A nuclear attack against China is unlikely to come out of the blue and is more likely to follow a period of increasing tension and possibly conventional warfare, allowing the warheads to be mated to the missiles in time. In April 2019, the Chinese delegation to the Preparatory Committee for the 2020 Review Conference of the Parties to the Treaty on the Nonproliferation of Nuclear Weapons provided a generic description of its alert posture and the stages Chinese nuclear forces would go through in a crisis:

In peacetime, the nuclear force is maintained at a moderate state of alert. In accordance with the principles of peacetime-wartime coordination, constant readiness, and being prepared to fight at any time, China strengthens its combat readiness support to ensure effective response to war threats and emergencies. If the country faced a nuclear threat, the alert status would be raised and preparations for nuclear counter-attack undertaken under the orders of the Central Military Commission to deter the enemy from using nuclear weapons against China. If the country were subjected to nuclear attack, it would mount a resolute counter-attack against the enemy. (Ministry of Foreign Affairs of the People’s Republic of China 2019)

In peacetime, the “moderate state of alert” might involve designated units to be deployed in high combat-ready condition with nuclear warheads installed or in nearby storage sites under control of the Central Military Commission that could be released to the unit quickly if necessary. China is building several underground facilities at some of its newer sites, including at its three solid-fuel missile silo complexes, which could potentially be used for warhead storage.

The Pentagon assesses that China’s construction of new silo fields and the expansion of its liquid-propellant ICBM force indicates its intent to move to a launch-on-warning (LOW) posture to increase the peacetime readiness of its nuclear forces (US Department of Defense 2023, viii). The Pentagon elaborates that part of the LOW posture involves implementing an “early warning counterstrike” strategy, relying on space- and ground-based sensors that would warn of an enemy missile strike that would give China time to launch its missiles before they would be destroyed (US Department of Defense 2023, 112).

As part of this effort, the Pentagon says that the PLARF continues to conduct exercises involving “early warning of a nuclear strike and LOW responses” (US Department of Defense 2023, 112). In its 2023 report, the Pentagon assessed that China “likely has at least three early warning satellites in orbit” to support its LOW posture as of mid-2023 (US Department of Defense 2023, 112).

In addition to the technical means for protecting the missiles against a first strike, the PLARF has also emphasized “survival protection” for its land-based nuclear forces (China Aerospace Studies Institute 2022, 386). This involves training soldiers to perform additional tasks beyond their primary roles, including a “role switch” where a transporter erector launcher (TEL) driver would also know how to launch a missile, or a measurement specialist who knows how to command (Baughman 2022). During one “survival protection” training exercise in November 2021, a launch battalion was informed they would be “killed” by an enemy missile strike in five minutes. Rather than attempting to evacuate—the standard “survival protection” procedure—the battalion commander ordered his troops to conduct a surprise “launch on the spot” of their ballistic missile before the enemy missile hit their position (Baughman 2022; Lu and Liu 2021). While the report did not specify whether the battalion had a nuclear or conventional strike role, the results of the exercise suggest that the PLARF is practicing launching missiles in a launch-on-warning scenario.

These data points, however, are not necessarily evidence of a formal shift to a more aggressive nuclear posture (Fravel, Hiim, and Trøan 2023). They could just as likely be intended to allow China to disperse its forces and, if needed, launch rapidly—but not necessarily “on warning”—in the context of a crisis, thereby safeguarding its forces against a surprise conventional or nuclear first strike. For decades, China has deployed silo-based DF-5s and road-mobile ICBMs that, in a crisis, would be armed with the intention to launch them before they are destroyed. China potentially could maintain its current strategy even with many new silos and improved early-warning systems.

Notably, both the United States and Russia operate large numbers of solid-fuel silo-based missiles and early-warning systems to be able to detect nuclear attacks and launch their missiles before they are destroyed. The two countries also insist that such a posture is both necessary and stabilizing. It seems reasonable to assume that China would seek a similar posture to safeguard its own retaliatory capability.

A Chinese early-warning system could potentially also be intended to enable a future advanced missile defense system. The latest Pentagon report on China’s military capabilities notes that China is developing an indigenous HQ-19 (known to the United States as CH-AB-X-02) anti-ballistic missile system as well as a hit-to-kill mid-course interceptor that could engage intermediate-range ballistic missiles and possibly ICBMs, although the latter would still take many years to develop (US Department of Defense 2023, 64). China already maintains several ground-based large phased-array radars that contribute to its nascent early-warning capabilities. The PLA continues to substantially invest in and improve its intelligence, surveillance, and reconnaissance (ISR) infrastructure and is reportedly progressing in its development of a space-based early warning capability (US Department of Defense 2023, 112).

China’s nuclear modernization—particularly the construction of hundreds of silos for solid-fuel missiles and the development of an “early warning counter-strike” strategy—has triggered significant debate about China’s longstanding no-first-use policy. Although there has been considerable discussion in China about the size and readiness of the nuclear arsenal as well as when the no-first-use policy would apply, there is little evidence to suggest that the Chinese government has deviated from it, which is also reiterated in its 2023 national defense strategy (Ministry of National Defense of the People’s Republic of China 2023b; Santoro and Gromoll 2020).

It remains unclear what circumstances could cause the Chinese leadership to order the use of nuclear weapons. In the past, Chinese officials have privately stated that China reserves the right to use nuclear weapons if its nuclear forces were attacked with conventional weapons. In addition, in 2023, the Pentagon’s annual report stated that “China’s nuclear strategy probably includes consideration of a nuclear strike in response to a non-nuclear attack threatening the viability of China’s nuclear forces or C2, or that approximates the strategic effects of a nuclear strike” (US Department of Defense 2023, 105).

The modernization of the nuclear forces could gradually influence Chinese nuclear strategy and declaratory policy in the future by offering more efficient ways of deploying, responding, and coercing with nuclear or dual-capable forces. The 2022 US Nuclear Posture Review suggested that China’s trajectory of expanding and improving its nuclear arsenal could “ … provide [China] with new options before and during a crisis or conflict to leverage nuclear weapons for coercive purposes, including military provocations against US Allies and partners in the region” (US Department of Defense 2022a, 4). Advanced non-nuclear weapons could also provide a strategic strike capability that may achieve effects similar to a first use of nuclear weapons (Kaufman and Waidelich 2023, 21).

This raises the question of whether China will leverage nuclear weapons in its “counter-intervention” strategy that aims to limit the US presence in the East and South China Seas and achieve reunification with Taiwan. China has made clear that it “keeps to the stance that China will not attack unless we are attacked, but China will surely counterattack if attacked. China will firmly defend its national sovereignty and territorial integrity, and resolutely thwart the interference of external forces and the separatist activities for ‘Taiwan Independence’” (Li 2022b).

Regardless of what the specific red lines may be, China’s no-first-use policy probably has a high threshold. Many experts believe there are very few scenarios in which China would benefit strategically from a first strike even in the case of conventional conflict with a military power such as the United States (Tellis 2022, 27). The Pentagon also assesses that the PLA most likely prioritizes conflict de-escalation when considering nuclear strike targets and would probably seek to avoid an extended series of nuclear exchanges against a superior adversary (US Department of Defense 2023, 105).

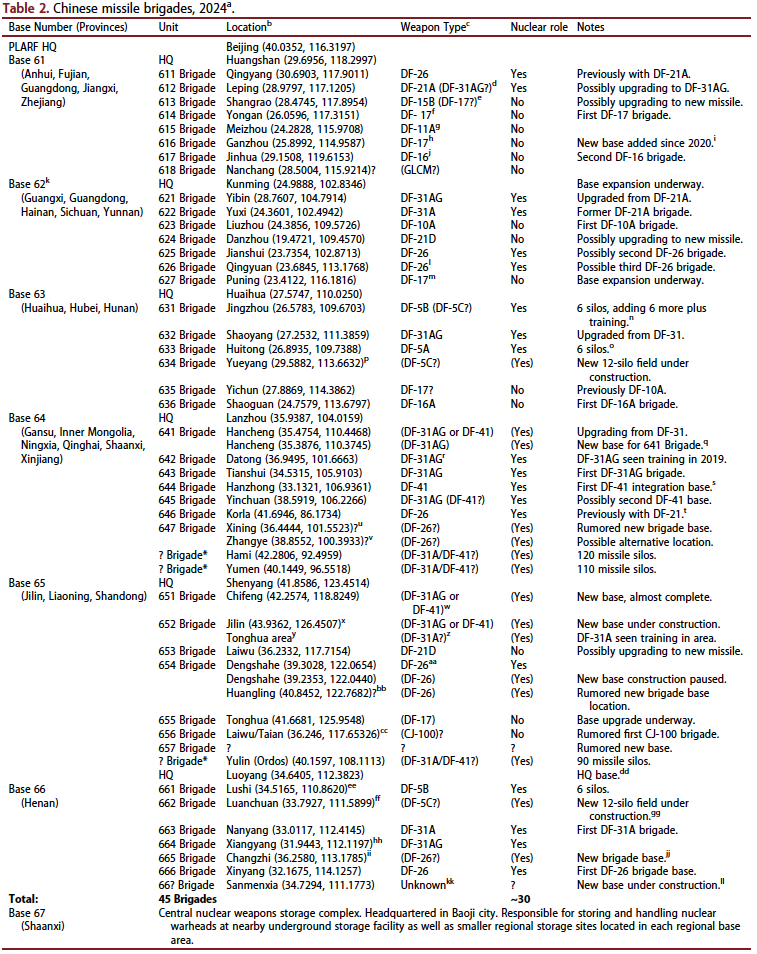

Land-based ballistic missiles

China is continuing the long-term modernization of its land-based, nuclear-capable missile force, but the pace and scope of this effort has increased significantly with the construction underway of approximately 350 new missile silos and several new bases for road-mobile missile launchers. Overall, we estimate that the PLARF currently operates approximately 350 launchers for land-based missiles that can deliver nuclear warheads (excluding new silos that are likely not yet fully operational). Of those missiles, nearly half—about 135—can reach the continental United States. Most of China’s ballistic missile launchers are for short-, medium-, and intermediate- range missiles intended for regional missions, and most of those do not have nuclear strike missions. We estimate there are about 108 nuclear warheads assigned to regional missiles, although this number comes with significant uncertainty.

The PLARF, which is headquartered in Beijing, has recently undergone several management shakeups: In July 2023, the PLARF commander and political commissar, along with several other senior officers, were removed from their positions following an anti-corruption investigation. Notably, the top two PLARF officials were replaced by generals from outside the PLARF itself: the new commander and political commissar come from the People’s Liberation Army Navy (PLAN) and the People’s Liberation Army Air Force (PLAAF), respectively (Lendon, McCarthy, and Chang 2023).

The PLARF controls nine individually-numbered bases: six for missile operations distributed across China (Bases 61 through 66), one for overseeing the central nuclear stockpile (Base 67), one for maintaining infrastructure (Base 68), and one that is assumed to be for training and missile tests (Base 69) (Xiu 2022, 2). Each missile operating base controls six to eight missile brigades, with the number of launchers and missiles assigned to each brigade depending on the type of missile (Xiu 2022, 5).

To accommodate the growing missile force, the total number of Chinese missile brigades has increased too. This increase is predominantly caused by the growing inventory of conventional missiles, but it is also a product of China’s nuclear modernization program. We estimate that the PLARF currently has approximately 45 brigades with ballistic or cruise missile launchers. Of those brigades, approximately 30 operate ballistic missile launchers with nuclear capability or are upgrading to do so soon (see Table 2). This is close to the 50 nuclear missile brigades operated by Russia—known as regiments in the Russian military (Kristensen, Korda, and Reynolds 2023).

Intercontinental ballistic missiles

We estimate that China currently operates approximately 134 ICBMs that can deliver nearly 240 warheads. The most significant recent development in China’s nuclear arsenal is the construction of what appears to be approximately 320 new missile silos in three desert areas across northern China (excluding the training silos at Jilantai) and the construction of 30 new silos in three mountainous areas of central-eastern China (Eveleth 2023; Korda and Kristensen 2021; Lee 2021; Lewis and Eveleth 2021; Reuter 2023).

Throughout the extensive construction period, each silo across the three new northern Chinese complexes was covered with an inflatable air dome to protect the site from environmental damage as well as from the prying eyes of satellite imagery analysts. These air domes were removed from all silos in the three new solid-fuel missile fields by the end of 2022, indicating that the most sensitive stages of construction had been completed by that point. The Department of Defense first declared them completed in late 2022 (Kristensen, Johns, and Korda 2023).

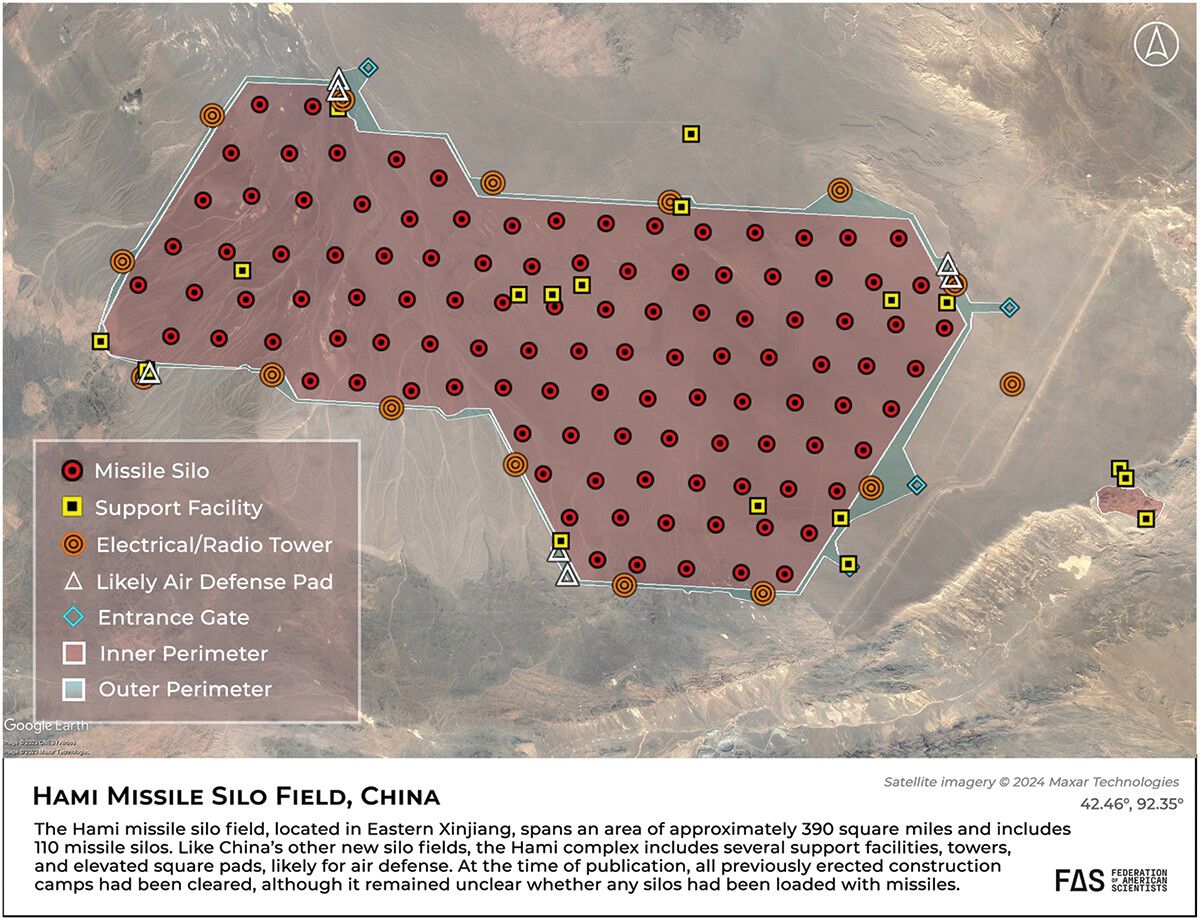

At each one of the three missile silo fields—as well as the training site at Jilantai—the silos are positioned roughly three kilometers apart in an almost perfect triangular grid pattern. The silo fields are located deeper inside China than any other known ICBM base, and beyond the reach of the United States’ conventional and nuclear cruise missiles. These facilities consist of the Yumen, Hami, and Yulin silo fields; details for which are rendered below:

Yumen silo field

The Yumen silo field, located in Gansu province in the western military district, covers an area of approximately 1,110 square kilometers with a perimeter fence surrounding the entire complex. The field includes 120 individual silos. There also appear to be at least five launch control centers scattered throughout the field, which are connected to the silos through underground cables.

In addition to the 120 silos, the Yumen field also includes dozens of supporting and defensive structures. These include multiple security gates in the north (40.38722° N, 96.52416° E) and south (40.03437° N, 96.69658° E), at least 23 support facilities, and approximately 20 surveillance or radio towers. Additionally, the Yumen field includes at least five raised square platforms around the perimeter of the complex, which could possibly be used for air and missile defense.

Construction of the field began in March 2020 and the last inflatable shelter was removed in February 2022, indicating that the most sensitive construction on each silo has now been completed. Construction at the Yumen field, which was first discovered by Decker Eveleth (Warrick 2021), is the furthest along out of the three silo complexes, and it is likely that the other two fields will likely follow a similar pattern and timeline.

Hami silo field

The Hami field, located in Eastern Xinjiang in the western military district, spans an area of approximately 1,028 square kilometers, roughly the same size as the Yumen field, and has also a perimeter fence around the entire complex.

The Hami silo field, which includes 110 missile silos, is at a less advanced stage of development compared to the Yumen field, with construction thought to have begun at the start of March 2021—roughly one year after Yumen. First discovered by Matt Korda (Korda and Kristensen 2021), the last of the Hami field’s inflatable domes were removed in August 2022.

Like Yumen, the Hami field includes at least three security gates-one in the north (42.46306º N, 92.34831º E) and two in the east (42.34269º N, 92.79957º E and 42.25023º N, 92.73585º E)—and at least 15 surveillance or radio towers, several potential launch control centers, and several raised square platforms for air-defense forces, matching those found at the Yumen field (Figure 4). There is also a separate fenced complex—located roughly 10 kilometers from the eastern fence of the main silo field—that includes several tunnels that could potentially be intended for warhead storage.

Yulin silo field

The Yulin field, located near Hanggin Banner west of Ordos, is smaller than the other two fields, measuring 832 square kilometers. It includes 90 missile silos, at least 12 support facilities, and several suspected launch control centers and air defense sites. Unlike the Hami and Yumen fields, the Yulin field does not yet have a significant fence perimeter.

Construction at the Yulin field, which was first reported by Roderick Lee (Lee 2021), began shortly after that of the Hami field (in April or May 2021), and it has a different layout than both the Yumen and Hami fields. Unlike the other two fields, the silos at the Yulin site are positioned in a slightly less grid-like pattern, although most silos are still spaced roughly three kilometers apart. In addition, the inflatable domes erected during construction at the Yulin field were all round, as opposed to the rectangular domes found at the Yumen and Hami fields, although this is likely due to logistical or construction reasons rather than a distinct difference between the silos themselves.

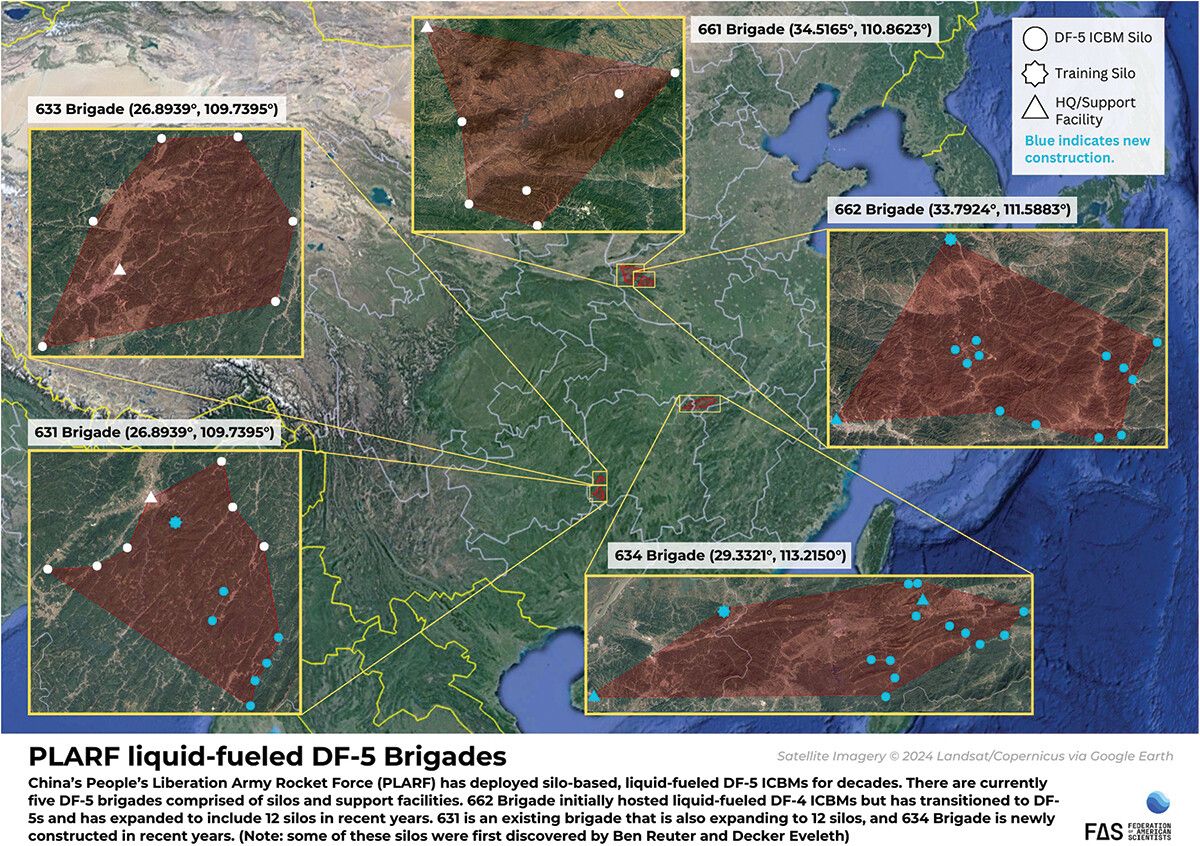

China’s ICBM force structure

In total, these discoveries suggest that China is constructing 320 new silos for solid-fueled ICBMs across the three fields of Yumen, Hami, and Yulin, excluding the approximately 15 training silos at the Jilantai site. In addition, China is upgrading and expanding the number of silos for the liquid-fueled DF-5 ICBM and increasing the number of silos per brigade (US Department of Defense 2023, 107). This appears to include doubling the number of silos of at least two existing DF-5 brigade and adding two new brigades each with 12 silos. Once completed, based on what is observable now, this project will increase the number of DF-5 silos from 18 to 48 (Figure 5).

Combined, these construction efforts for silo-based ICBMs (in addition to new road-mobile ICBM bases) constitute the largest expansion of the Chinese nuclear arsenal ever. The 350 new Chinese silos under construction exceed the number of silo-based ICBMs operated by Russia and constitutes about three-quarters the size of the entire US ICBM force.

In addition to the construction of new ICBM facilities, there is uncertainty about how many ICBMs China currently operates. The (US Department of Defense’s 2023) report about China’s military and security developments assessed that, as of October 2023, China had 500 ICBM launchers with 350 missiles in its inventory (US Department of Defense 2023, 186). The previous report from 2022 listed 300 launchers with as many missiles as of the end of 2021 (US Department of Defense 2022b, 167). The sharp increase in launchers over only a two-year period suggests that the US Department of Defense is now counting all of China’s new silos in its ICBM launcher estimate. However, it is unlikely that most of these new silos were loaded with missiles as of October 2023. Analysis of satellite imagery show ongoing construction at all three fields indicating that they may still be several years away from full operational capability.

In its 2023 report, the Pentagon assessed that the three new silo fields were “capable of fielding both DF-31 and DF-41 class ICBMs,” but noted that China “probably began to load [a silo-based version of a DF-31-class ICBM] at its new silo fields” (US Department of Defense 2023, 104, 107).

If each new silo is filled with a single-warhead DF-31-class ICBM, the total number of warheads in China’s ICBM force could potentially reach 648 warheads during the 2030s, more than twice as many as today. In addition, if all the new silos were loaded with DF-41 ICBMs (each carrying up to three warheads), then the active Chinese ICBM force could potentially carry more than 1,200 warheads once all three silo fields are completed. However, it is currently unknown how China will operate the new silos—whether they will be loaded with just silo-based DF-31-class ICBMs or a mix of DF-31As and DF-41s; whether all silos will be filled; and how many warheads each missile will carry. Regardless of what missile type ends up in each silo, the sheer number of silos will likely have a significant effect on US strike plans against China because the US targeting strategy is typically focused on holding nuclear and other military targets at risk.

At this stage of construction, it is unclear how these hundreds of new silos will alter the existing brigade structure for China’s missile forces. Presently, each of China’s ICBM missile brigades is responsible for six to 12 launchers. Each new missile silo field might be organized as a single brigade, but some analysts have hypothesized that the new silo fields could lead to the creation of entirely new PLARF “Bases” (each with several brigades)—an extremely rare event that has not taken place in more than 50 years (Xiu 2022, 255). For now, the Pentagon’s 2023 report on China shows the Hami and Yumen missile silo fields as “Missile Brigades” in the Western Theater organized under Base 64, and the Yulin missile silo field as a “Missile Brigade” in the Northern Theater organized under Base 65 (US Department of Defense 2023, 129, 133).

Although China has deployed ICBMs in silos since the early 1980s, building missile silos on this scale is a significant shift in China’s nuclear posture. The decision to do so has probably not been caused by a single event or issue but, rather, by a combination of strategic and operational objectives, including protecting the retaliatory capability against a first strike, overcoming the potential effects of adversarial missile defenses, better balancing the ICBM force between mobile and silo-based missiles, increasing China’s nuclear readiness and overall nuclear strike capability to account for improvements in the Russian, Indian, and US nuclear arsenals, elevating China to a world-class military power, as well as national prestige.

Currently two versions of the DF-5 are deployed: the DF-5A (CSS-4 Mod 2) and the MIRVed DF-5B (CSS-4 Mod 3). Since 2020, the Pentagon’s annual reports to Congress have noted that the DF-5B can carry up to five MIRVs (US Department of Defense 2020a, 56). We estimate that two-thirds of the DF-5s are currently equipped to carry MIRVs. In its 2023 annual report, the Pentagon indicated that a third modification with a “multi-megaton yield” warhead—known as the DF-5C—is currently being fielded (possibly in some of the new silos) and that China is “probably developing an upgrade” to the DF-5B as well (US Department of Defense 2023, 107).

In 2006, China debuted its first solid-fuel road-mobile ICBM—the DF-31 (CSS-10 Mod 1)—which had a range of about 7,200 kilometers, meaning that it could not reach the continental United States from its deployment areas in China.[2] Since then, China has iterated on its original DF-31 design, producing newer versions of the missile (the DF-31A and DF-31AG, and possibly one additional silo-based variant) with extended ranges and improved maneuverability. As of October 2023, it is assumed that these newer variants have completely replaced all the legacy DF-31s in China’s arsenal.

The DF-31A (CSS-10 Mod 2) is an extended-range version of the DF-31. With a range of 11,200 kilometers, the DF-31As can reach most of the continental United States from most deployment areas in China. Each DF-31A brigade used to operate only six launchers but they have recently been upgraded to operate 12 (Eveleth 2020). In 2020, the US Air Force’s National Air and Space Intelligence Center (NASIC) estimated the number of DF-31A launchers to be more than 15 (National Air and Space Intelligence Center 2020, 29). However, given the number of bases observed that possess the launchers, we estimate that China now deploys a total of about 24 DF-31As in two brigades.

In his March 2023 testimony before Congress, US STRATCOM Commander Gen. Cotton suggested that the DF-31A ICBM could carry MIRVs. This differs from NASIC’s 2020 estimate that the DF-31As are equipped with only one warhead per missile, as well as from the Pentagon’s 2022 annual China report, which referred to the DF-41 as “China’s first road-mobile and silo-based ICBM with MIRV capability,” therefore indicating that the DF-31A is not MIRV-capable (Cotton 2023; National Air and Space Intelligence Center 2020, 29; US Department of Defense 2022b, 94). It remains unclear whether the discrepancy can be attributed to updated intelligence, to an incorrect statement by the US STRATCOM commander, or to divergent assumptions by different branches of the Intelligence Community. It is also unclear how the DF-31 family could be MIRV-capable unless China has also designed a smaller-diameter MIRV warhead. Adding warheads would also reduce the range of the missile due to a heavier payload. For these reasons and in the absence of further information, we assume that the DF-31A is deployed with a single warhead.

According to the Pentagon’s 2022 recent China report, Chinese media sources have suggested that a DF-31B variant might be in development; however, no further information was given about the system and it was not included in the Pentagon’s 2023 China report (US Department of Defense 2022b, 65; 2023).

Since 2017, China’s road-mobile ICBM modernization effort has focused on supplementing, and possibly replacing the initial DF-31 versions with the newer DF-31AG and increasing the number of associated bases. The DF-31AG’s new eight-axle launcher is thought to carry basically the same missile as the DF-31A launcher but has improved off-road capabilities. The US Air Force NASIC’s 2020 missile report listed the DF-31AG as having an “UNK” (unknown) number of warheads per missile in contrast to the DF-31A, which was listed with only one warhead. This suggests that the AG version could potentially have a different payload (National Air and Space Intelligence Center 2020, 29). However, for the same reasons as for the DF-31A, we assume that the DF-31AG is also deployed with a single warhead.

The Pentagon’s 2022 report noted that the number of launchers in mobile ICBM units is increasing from six to 12 (US Department of Defense 2022b, 95), although this is only true for some of brigades as some new bases appear to have eight launchers.

Even though all Chinese DF-31-class ICBMs have traditionally been mobile missiles, the Pentagon’s 2023 report noted that China may be currently fielding a silo-based version as well (US Department of Defense 2023, 107). This variant’s missile designation is not yet known.

The next phase of China’s ICBM modernization is the integration of the long-awaited DF-41 ICBM (CSS- 20) that began development back in the late 1990s. Eighteen DF-41s were mobilized for China’s 70th National Day parade in October 2019; the 16 that were displayed were said to come from two brigades (New China 2019). In April 2021, the commander of US Strategic Command testified to Congress that the DF-41 “became operational [in 2020], and China has stood up at least two brigades” (Richard 2021, 7). A third base appears to have been completed and several other bases may be upgrading to receive the DF-41 as well. The number of garages at the bases indicate that there may be approximately 28 DF-41 launchers deployed.

In previous Nuclear Notebooks, we estimated that the DF-41 could carry up to three MIRVs, which the Pentagon’s 2023 China report appeared to validate (US Department of Defense 2023, 107). It is unknown if all DF-41s will be equipped with MIRVs or if some will have only one warhead to maximize range. In addition to road-mobile launchers, the Pentagon says that China “appears to be considering DF-41 additional launch options, including rail-mobile and silo basing” (US Department of Defense 2022b, 65). In the Pentagon’s 2023 report, the “silo basing” mode appears to refer to China’s new silo fields at Yumen, Hami, and Yulin.

China also appears to be developing a new missile, known as the DF-27 (CSS-X-24), which reportedly has a range between 5,000 and 8,000 kilometers (US Department of Defense 2023, 67). This range class is somewhat redundant for the nuclear strike mission, as these distances can already be easily covered by China’s longer-range ICBMs. It is therefore potentially possible that the system could ultimately be used in a conventional strike role. The Pentagon’s 2023 report indicated that China “may be exploring development of conventionally-armed intercontinental range missile systems,” which could potentially refer to the DF-27 (US Department of Defense 2023, 67). Reporting surrounding the DF-27 is highly unclear, however: The Pentagon’s 2023 report states that the missile is “in development.” Moreover, a US intelligence assessment of February 2023 notes that “land attack and antiship variants [of the DF-27] likely were fielded in limited numbers in 2022,” whereas in May 2023 the South China Morning Post reported that the DF-27 has been in service since 2019, citing a Chinese military source (Chan 2023; US Department of Defense 2023, 67). In June 2021, Chinese state media broadcasted videos of was rumored to be a military exercise featuring the DF-27 (Tiandao 2022), which strongly resembles the DF-26 with an attached conical hypersonic glide vehicle (HGV). This would be similar to how the DF-17 resembles a DF-16 with an attached HGV. US intelligence assessed in February 2023 that China conducted a developmental flight test of a “multirole HGV” for the DF-27, which flew for around 12 minutes and traveled approximately 2,100 kilometers (Chan 2023).

The Pentagon’s 2023 report noted that “China probably is developing advanced nuclear delivery systems such as a strategic hypersonic glide vehicle and a fractional orbital bombardment (FOB) system” (US Department of Defense 2023, 67). As of October 2023, China has tested each of these systems at least once. In July 2021, China conducted a test of a new FOB system equipped with a hypersonic glide vehicle, an event described as an unprecedented achievement for a nuclear-armed country (Sevastopulo 2021). According to the Pentagon, the system came close to striking its target after flying around the world, and “demonstrated the greatest distance flown (~40,000 kilometers) and longest flight time (~100+ minutes) of any [Chinese] land- attack weapons system to date” (US Department of Defense 2022b, 65). An operational FOB/HGV system would pose challenges for missile tracking and missile defense systems, as it could theoretically orbit around the Earth and release its maneuverable payload unexpectedly with little detection time, although the US missile defense system is not intended to defend against Chinese missiles. In 2023, the Pentagon assessed that China’s developmental FOB system is likely intended to have a nuclear strike role (US Department of Defense 2023, 67).

Medium- and intermediate-range ballistic missiles

For decades, the DF-21 missile family constituted China’s primary regional nuclear-capable system. The DF-21A (CSS-5 Mod 2) is a two-stage, solid-fuel, road- mobile, medium-range ballistic missile (MRBM) with a range of about 2,150 kilometers (the unclassified range is 1,750 kilometers). Since 2016, China appears to have been fielding a new version of this missile, the CSS-5 Mod 6, possibly known as DF-21E. In recent years, however, several DF-21 brigades have converted—or are in the process of converting—to longer-range missile types, such as the DF-26 IRBM or the DF-31AG ICBM. For the first time, the Pentagon’s 2023 report did not include the DF-21 in a nuclear role, apparently implying that all remaining DF-21s are now serving only a conventional role.

With the apparent retirement of the DF-21’s nuclear mission, the regional nuclear mission is now assessed to be exclusively performed by the DF-26 (CSS-18) intermediate-range ballistic missile (IRBM). The DF-26 missile is dual-capable and launched from a six-axle road-mobile launcher. With its approximate 4,000-kilometer range, the DF-26 can target important US bases in Guam, as well as large parts of Russia and all of India.

In its annual reports, the Pentagon has stated that the DF-26 force has grown from 16 to 30 launchers in 2018 to 250 launchers with 500 missiles by October 2023 (US Department of Defense 2023, 67). Given how the Pentagon counts other Chinese systems, these estimates may also include launchers in production. We estimate that approximately 216 launchers in six brigades are now in operation, with several other brigades that may be upgrading to also operate the DF-26.

It seems unlikely that all dual-capable DF-26s serve a nuclear mission. Most of them probably serve conventional missions with nuclear warheads having been produced only for use by some of the launchers. One brigade, the 646 Brigade at Korla, is reportedly tasked with both nuclear and conventional strike missions, the first time this type of dual mission had been confirmed within a single brigade (Xiu 2022, 129, 131). To enable this dual mission, the DF-26 is reportedly capable of rapidly swapping out warheads, potentially even after the missile has been loaded onto its launch vehicle (Pollack and LaFoy 2020; US Department of Defense 2023, 67). With the DF-21’s nuclear role being retired, we cautiously estimate that probably only half of the DF-26 launchers now serve a regional nuclear role.

The dual-capable role of the DF-26 raises some thorny issues about command and control and the potential for misunderstandings in a crisis. Preparations to launch—or the actual launch of—a DF-26 with a conventional warhead against a US base in the region could potentially be misinterpreted as the launch of a nuclear weapon and trigger nuclear retaliation—or even preemption. China is one of several countries (including India, Pakistan, and North Korea) that mix nuclear and conventional capability on medium- and intermediate-range ballistic missiles.

Citing Chinese defense industry publications, official media commentary, and military writings, the US Department of Defense assessed in 2023 that the DF-26 could eventually be used to “field a lower-yield warhead in the near term” (US Department of Defense 2023, 111–112). In addition, US STRATCOM Commander testified in March 2023 that China was making an “investment in lower-yield, precision systems with theater ranges” (Cotton 2023, 6). It is unclear what “lower-yield” warhead means; it is not necessarily the same as an explicitly “low-yield warhead.”

Previous claims that the DF-17 may be dual-capable have not been substantiated. The Pentagon’s 2022 China report noted that “[w]hile the DF-17 is primarily a conventional platform, it may be equipped with nuclear warheads” (US Department of Defense 2022b, 65). But this language was removed in the 2023 report, which only describes the DF-17 as a conventional weapon (US Department of Defense 2023). Consequently, we no longer include the DF-17 in our estimate of Chinese nuclear forces.

Submarines and sea-based ballistic missiles

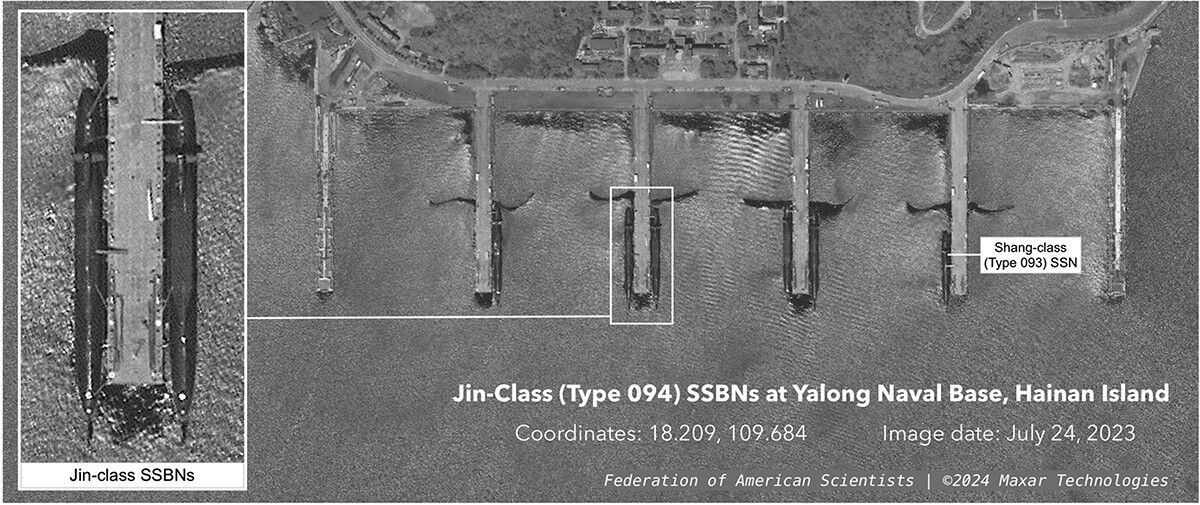

China currently fields a submarine force of six second-generation Jin-class (Type 094) nuclear-powered ballistic missile submarines (SSBNs), which are based at the Yalong naval base near Longposan on Hainan Island. The two newest SSBNs are believed to be improved variants of the original Type 094 design. Some Chinese journals refer to it as the Type 094A but this has not been confirmed by either the Pentagon or the Chinese government. These SSBNs include a more prominent hump, which initially triggered some speculation as to whether they could carry up to 16 submarine-launched ballistic missiles (SLBMs), instead of the usual 12 (Suciu 2020; Sutton 2016). However, satellite images subsequently confirmed that the new subs are equipped with 12 launch tubes each (Kristensen and Korda 2020). The upgrades were later assessed to be related to sound silencing (Carlson and Wang 2023, 18).

Per the Pentagon’s most recent China Military Power Report, China has equipped its Jin-class SSBNs to carry either the 7,200-kilometer range JL-2 (CSS-N-14) SLBM or the longer-range JL-3 (CSS-N-20) SLBMs, and China has likely begun replacing the JL-2s with JL-3s on a rotational basis as each submarine returns to port for routine maintenance and overhaul (US Department of Defense 2023, 55). The range of the JL-2 was sufficient to target Alaska, Guam, Hawaii, Russia, and India from waters near China, but not the continental United States—unless the submarine sailed deep into the Pacific Ocean to launch its missiles. With the JL-3’s longer range of roughly 10,000 kilometers, a submarine will be able to target the northwestern parts of the continental United States from Chinese waters, but it would still not be able to target Washington, DC without sailing past northeast Japan (National Air and Space Intelligence Center 2020, 33). Unlike the JL-2, the JL-3 allegedly can deliver “multiple” warheads per missile (National Air and Space Intelligence Center 2020, 33). The People’s Liberation Army Navy reportedly conducted its first test of the JL-3 in November 2018 (Gertz 2018) and appears to have conducted at least two—possibly three—additional tests since then (Chan 2020; Guo and Liu 2019).

Although the Jin-class is more advanced than China’s first experimental SSBN—the single and now inoperable Xia (Type 092)—it is a noisy design compared with current US and Russian missile submarines. It is suspected that the Type 094 remains two orders of magnitude louder than the top Russian or American SSBNs (Coates 2016). For that reason, China would continue to face constraints and challenges when operating its SSBN force in a conflict (Kristensen 2009). It therefore seemed likely that China would end production after its now-completed six boats and turn its efforts to developing the quieter third-generation (Type 096) SSBN, which was scheduled to begin construction in the early 2020s. However, the Pentagon’s 2023 report to Congress stated that China has continued constructing additional Jin-class SSBNs and speculates that this could be due to delays in development of the Type 096 (US Department of Defense 2023, 108).

The completion of a new construction hall at Huludao, where the People’s Liberation Army Navy’s submarines are built, indicated that work would soon begin on the Type 096, which is expected to be larger and heavier than the Type 094 (Sutton 2020). Satellite images show wider hull sections at Huludao, suggesting that production of a larger submarine may have started (Sutton 2021), although it is not clear whether it corresponds to a new attack submarine or the larger Type 096 SSBN. As with all new designs, the Type 096 is expected to be quieter than its predecessor. Some even believe it could be as quiet as Russia’s new Borei-class SSBNs (Carlson and Wang 2023, 30), although that would be a significant technological leap for China. Some anonymous defense sources have speculated the Type 096 will carry 24 missiles (Chan 2020), but there are no public official sources confirming this information. Current and projected missile inventories seem to indicate that the SSBN will more likely carry 12 to 16 missiles. The Pentagon’s 2023 report stated that the Type 096 SSBNs “will reportedly be armed with a follow-on longer range SLBM,” and that these SLBMs will probably be MIRVed (US Department of Defense 2023, 55, 108).

Given that China’s SSBNs are assumed to have a service life of approximately 30 to 40 years, the US Department of Defense expects that the Type 094 and Type 096 boats will operate concurrently (US Department of Defense 2023, 108). If confirmed, this could potentially result in a future fleet of eight to 10 SSBNs. All of China’s six SSBNs—and several attack submarines—are based at the Yalong naval base on Hainan Island where satellite photos show expansion of piers to accommodate more submarines. Figure 6 shows that five of six SSBNs were in port in July 2023.

The Pentagon’s 2022 report indicated that China had recently begun “near-continuous at-sea deterrence patrols with its six JIN class SSBNs” in 2021 (US Department of Defense 2022b, 96), and the 2023 report asserted that China “probably continued to conduct” these patrols throughout 2022 (US Department of Defense 2023, 108). The term “near-continuous” implies that the SSBN fleet is not on patrol all the time but that at least one boat is deployed intermittently. The term “deterrence patrol” could imply that the submarine at sea has nuclear weapons onboard, although US officials have not explicitly stated so. Giving custody of nuclear warheads to deployed submarines during peacetime would constitute a significant departure from Chinese declaratory policy and a significant change for China’s Central Military Commission, which has historically been reluctant to hand out nuclear warheads to the armed services.

To fully develop a survivable sea-based nuclear deterrent posture, China is presumably improving its command and control system to ensure reliable communication with the SSBNs when needed and prevent the crew from launching nuclear weapons without authorization. Moreover, the SSBN fleet will have to operate safely in patrol areas from where its missiles can reach intended targets. Western military officials have privately stated that the United States, Japan, Australia, and the United Kingdom “are already attempting to track the movements of China’s missile submarines as if they are fully armed and on deterrence patrols” (Torode and Lague 2019). Whenever they put to sea in this region, China’s SSBNs typically appear to be accompanied by a protection detail, including surface warships and aircraft (and possibly attack submarines) capable of tracking adversarial submarines (Torode and Lague 2019).

Given the noise level of the SSBNs, it seems likely that China during conflict would keep the submarines inside a protected “bastion” in the South China Sea (US Department of Defense 2023, 108). But even with the JL-3 SLBM, the SSBNs would not be able to target the continental United States from the South China Sea. To do that, they would have to sail far north. Even if they patrolled inside the Bohai Sea, the missiles would only be able to target the northwestern parts of the continental United States—not Washington, DC.

Bombers

China developed several types of nuclear bombs and used aircraft to deliver at least 12 of the nuclear weapons that it detonated in its nuclear testing program between 1965 and 1979. Later, however, the People’s Liberation Army Air Force (PLAAF) nuclear mission became dormant as the rocket force improved and older intermediate-range bombers were unlikely to be useful or effective in the event of a nuclear conflict. Still, it is reasonable to assume that China maintained a small inventory of gravity bombs—perhaps up to 20—for potential contingency use by aircraft. Formally, however, the US Department of Defense assessed in 2017 that the “People’s Liberation Army Air Force does not currently have a nuclear mission” (US Department of Defense 2017, 61).

Coinciding with a renewed emphasis on nuclear aircraft modernization, the US Department of Defense reported in 2018 that the People’s Liberation Army Air Force “has been newly re-assigned a nuclear mission” (US Department of Defense 2018a, 75, 34). This new mission appears to be currently centered around China’s current H-6 “Badger” bomber, which may have two distinct nuclear-capable variants. The upgraded H-6K version is an extended-range version of the original H-6 bomber that has reportedly been described by Chinese media sources as a “dual nuclear-conventional bomber” (US Department of Defense 2019, 41). The H-6N is another variant that is distinct from that of the H-6K bomber through its incorporation of a nose-mounted in-flight refueling probe (Rupprecht 2019) and a modified fuselage that the US Department of Defense has stated can accommodate a nuclear-capable air-launched ballistic missile (ALBM) (US Department of Defense 2022b, 50). Notably, the airframe modification includes the removal of the bomb bay, indicating that if a legacy gravity bomb capability still existed for the PLAAF, the H-6N would not be part of that contingency mission.

The ALBM appears to bear resemblance to China’s DF-21 MRBM and the nuclear-capable version has been designated by the United States as CH-AS-X-13. It is potentially possible that a conventional anti-ship variant like that of the DF-21D exists (Newdick 2022; Panda 2019). The developmental ALBM was first tested in December 2016 and at least five times by April 2018 (Panda 2019). In 2019, a US intelligence community source told The Diplomat that the missile would be ready for deployment by 2025 (Panda 2019). This fits the US Department of Defense’s early-2020 estimate that a “TBD [name to be determined] ALBM” is “in research & development within 10 years” (US Department of Defense 2020b, 3). The Pentagon assessed that, once complete, this nuclear ALBM will, “for the first time, provide China with a viable nuclear ‘triad’ of delivery systems dispersed across land, sea, and air forces” (US Department of Defense 2019, 67).

One of the first bomber units to get an operational nuclear capability with the ALBM might be the 106th Brigade at Neixiang Air Base in the southwestern part of Henan province. The base has been modified extensively with large tunnels into a nearby mountain large enough to accommodate the H-6 bomber. Civilian video footage from October 2020 appears to show an H-6N bomber flying with the possible new ALBM just outside of Neixiang Air Base, one of China’s only airfields with an adjacent air defense site (Lee 2020a, 2020b; Rupprecht and Dominguez 2020).

To eventually replace the H-6, China is developing a stealth bomber with longer range and improved capabilities. The Pentagon asserts that the new bomber, known as H-20, will have both a nuclear and conventional capability with a range exceeding 10,000 kilometers, and may be revealed sometime during the next decade. If equipped with an aerial refueling capability, the Pentagon assesses that the bomber could potentially have intercontinental range (US Department of Defense 2023, 92).

Cruise missiles

From time to time, various US military publications have asserted somewhat vaguely that one or more of China’s cruise missiles might have nuclear capability. For example, a nuclear modernization fact sheet published by the Pentagon in connection with the release of the 2018 Nuclear Posture Review claimed, without identifying them, that China had both air-launched and sea-launched nuclear cruise missiles (US Department of Defense 2018b). The Pentagon has not substantiated this claim since. The 2023 Japanese Defense Paper, however, stated that the H-6 bombers “are believed to be capable of carrying long-range attack cruise missiles with nuclear capability” (Japanese Ministry of Defense 2023, 67).

It is still unclear what this missile could be. Therefore, we continue to assess that, although China might have developed warhead designs for potential use in cruise missiles, it currently has no nuclear cruise missiles in its active stockpile. It is possible, but unconfirmed, that the future H-20 could be equipped with a nuclear cruise missile.

This research was carried out with generous contributions from New-Land Foundation, Ploughshares Fund, the Prospect Hill Foundation, Longview Philanthropy, and individual donors.

Notes

[1] Nuclear weapons are stored in central facilities under the control of the Central Military Commission. Should China come under nuclear threat, the weapons would be released to the Second Artillery Corps to enable missile brigades to go on alert and prepare to retaliate. For a description of the Chinese alerting concept, see Kristensen, (2009b). For more on warhead storage in China, see Stokes (2010). For an overview of the People’s Liberation Army Rocket Force structure and organization, see Stokes (2018) and Xiu (2022). For an insightful overview of Chinese thinking about nuclear weapons and policies, see Santoro and Gromoll (2020).

[2] The “continental United States” as used here includes only the lower 48 states. US states and territories outside of the continental United States include Alaska, Hawaii, Guam, American Samoa, Puerto Rico, the US Virgin Islands, and many tiny Pacific islands.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: China, Nuclear Notebook, ballistic missiles, nuclear arsenal, nuclear risk, nuclear weapons

Topics: Nuclear Notebook, Nuclear Weapons