Between COVID-19 and a price war, Canada’s oil patch is on life support

By Ainslie Cruickshank | March 23, 2020

Skyline of Edmonton, Alberta—sometimes called the “Oil Capital of Canada.” Image courtesy of Pixabay.

Skyline of Edmonton, Alberta—sometimes called the “Oil Capital of Canada.” Image courtesy of Pixabay.

Editor’s note: This story was originally published by Canada’s National Observer. It appears here as part of the Climate Desk collaboration.

In the face of an economic crisis triggered by the global spread of COVID-19 and worsened by the Saudi Arabia-Russia price war, the outlook for new projects in Alberta’s oil patch – even those already approved – is bleak.

The federal government announced a major economic aid package Wednesday, as the country “teeters on the brink of recession,” according to an economic forecast released Tuesday by the Conference Board of Canada.

In the meantime a number of oilsands projects that have already secured a greenlight could be in limbo as oil companies face plunging prices, based on a list of approved projects that are not currently operating provided to National Observer by the Alberta Energy Regulator (AER).

The list contains more than 45 projects, including projects that have been “approved but not constructed”; projects that have been “approved, constructed, then postponed or delayed”; projects that have been “approved, constructed, began operating, then suspended”; and projects that have not been constructed “but are planning to operate in the future,” according to the AER.

Prime Minister Justin Trudeau and Finance Minister Bill Morneau announced $82 billion in economic aid Wednesday to help lessen the impact of the COVID-19 pandemic. As of Thursday morning, there were more than 735 confirmed cases of COVID-19 in Canada and 34 probable cases. The Canada-U.S. border has now been closed to all non-essential travel in an effort to slow the spread of the virus.

The government’s economic response to the crisis includes $27 billion in direct support to individuals and businesses and $55 billion in tax deferrals. Targeted measures to support the oil and gas industry and other particularly affected sectors are on their way but have yet to be announced.

“We’re going to actively work with organizations in the oil and gas sector, in the airline sector in order to come up with approaches that enable them to bridge through the challenging time, that’s critical,” Morneau said.

“We’re not far enough along in those discussions to identify specific measures that we will take, but we do recognize the urgency of those discussions and are proceeding with that in mind.”

For Alberta’s oil and gas industry, the situation is nothing short of a crisis, one that’s left the fate of multiple projects uncertain.

Among those that have been approved, but not yet constructed are Suncor’s Meadow Creek projects.

Just last month – two weeks before the Alberta government gave its Meadow Creek West project the final nod – Suncor announced it was shelving both its Meadow Creek West and Meadow Creek East projects until at least 2023.

That was before the U.S. Energy Information Administration downgraded its 2020 oil price forecast for the benchmark West Texas Intermediate to an average $38 U.S. per barrel, down from an earlier forecast of $55 per barrel this year. The WTI was above the $25.00 U.S. a barrel mark mid-day Thursday, while the price for Western Canadian Select was slightly above the $11.00 mark during the same time period.

In light of a major decline in demand brought on by the pandemic and the oil price crash triggered by the price war, Kevin Birn, a crude oil market analyst with IHS Markit, said he thinks “it’s very unlikely that… projects (will) advance at this point.”

Over the last several days oil companies in Alberta have announced major cuts to their capital budgets for 2020, prompting expectations of layoffs.

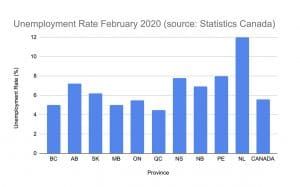

“This is going to have a very negative effect for working women and men in the energy services sector,” said Premier Jason Kenney, whose province had the highest unemployment rate of any province outside of Atlantic Canada as of February.

After years of economic stagnation, the province is “facing a triple whammy right now,” he said, and Ottawa “needs to have our back.”

While Kenney has called for major investments and relief from certain planned environmental measures to help keep Alberta’s mainstay industry afloat, others say economic stimulus measures could offer an opportunity to address two emergencies at once – the pressing economic crisis and the relatively longer-term threat of catastrophic climate change.

“For Canada’s oil and gas sector to have greater longevity, it needs to be cleaner, it needs to have lower carbon intensity,” said Dan Woynillowicz, the deputy director of Clean Energy Canada.

New projects already faced challenging conditions. Oilsands producers have been struggling under the weight of depressed prices and limited pipeline access for a number of years now.

That reality was brought into sharp focus earlier this year when Teck Resources pulled the regulatory application for its massive Frontier oilsands mine.

But even before Teck’s surprise decision, analysts were questioning the economic feasibility of such a major undertaking in the oilsands, as well as the fate of numerous other projects, approved already.

Final investment decisions have yet to be made for a number of the approved projects on the list provided to National Observer by the AER, including MEG Energy’s Surmont Project, a proposed multi-phase, in-situ project that could produce up to 120,000 barrels per day.

Though the company secured regulatory approval for the project in 2019, MEG Energy shifted the Surmont Project out of its current development plan, a move “consistent with its strategic focus on continued application of all free cash flow to debt reduction,” according to corporate documents.

In March 2019, just a few months after Imperial Oil announced it was moving forward with its $2.6 billion Aspen project, the company announced it was slowing the pace of development due to the Alberta Government’s curtailment policy.

“We cannot invest billions of dollars on behalf of our shareholders given the uncertainty in the current business environment. That said, our goal is to ensure the work we do this year will enable us to effectively and efficiently resume planned activity levels when the time is right,” Rich Kruger, the then-CEO of Imperial Oil, said in a statement.

Suncor, meanwhile, has deferred an investment decision on its Meadow Creek in-situ projects until 2023 in favour of lower-cost opportunities to improve production at its Firebag site, CEO Mark Little said during the company’s 2019 fourth-quarter investor call in early February.

“As you would expect in line with our capital discipline principles, we’re carefully evaluating future projects,” Little said. “We take into account the current environment of volatile commodity prices, market access challenges and government intervention into crude markets, while at the same time we’re making progress on new technology development, which has the potential to significantly reduce capital and operating costs, greenhouse gas emissions and water use.”

In 2015, due to low oil prices, Cenovus deferred new spending on construction for the first phase of its Narrows Lake project, which received approval for three phases in 2012, according to corporate financial documents. The project, which was initially designed to have capacity to produce 130,000 barrels per day, is now being reconceived as a lower-cost “tieback” project. Meaning, the company is looking at using its existing infrastructure at its Christina Lake site to produce the Narrows Lake resource.

While expected production would be in the 65,000 barrels per day range, the approach could cut costs by more than 30 per cent compared with the previous plan, according to an October 2019 presentation to investors. At the time, Cenovus said it could be ready to make a final investment decision in the second half of 2020, depending on market access.

Capital investments in the oil patch have declined since 2014, but just a few months ago, there was some expectation that the investment picture in the oilsands would improve this year as new pipelines came online.

“Of course, that’s all changed now,” said Pedro Antunes, the chief economist at the Conference Board of Canada in an interview with National Observer.

In the wake of the price crash, oilsands companies have made dramatic cuts to capital budgets for the year ahead.

On Wednesday, Canadian Natural Resources Limited announced a $1 billion-reduction to its 2020 capital spending budget, though the company noted in a release today that it “is well positioned through the current global COVID-19 challenges.”

Cenovus announced it was cutting its capital spending plans by 32 per cent and “deferring final investment decision on major growth projects.”

MEG Energy announced a 20 per cent reduction to its 2020 capital budget, and ARC Resources cut its 2020 capital budget from $500 million to at-most $300 million.

Husky Energy, meanwhile, scrapped $1 billion from its capital investment plans this year. “Investment in resource plays and conventional heavy oil projects in Western Canada has been halted, with a focus on optimizing existing production and lowering costs,” the company said in a release last week.

A pandemic and a price war. The novel coronavirus outbreak and related slowdown of China’s economy had a dramatic effect on the demand for oil. As manufacturing and transportation stalled, supply quickly outpaced demand, said Birn.

As more countries take steps to slow the spread of the virus, demand could decline even further. This week Prime Minister Justin Trudeau announced the federal government was restricting inbound international flights to just four Canadian airports and closing the borders for non-essential travel.

In its February Oil Market Report, the International Energy Agency said global demand for oil is expected to decline in the first quarter of 2020 in what would be “the first quarterly contraction in more than 10 years.”

Prices were already expected to slide throughout the year as demand fell further and stockpiles grew, said Birn. Then, the situation took a turn for the worse.

The Organization of the Petroleum Exporting Countries (OPEC) proposed a cut in production to help address the growing gulf between supply and demand, but got no buy-in from Russia. In response, Saudi Arabia cut its prices and announced plans to ramp up production in an effort to increase its market share.

The price of oil crashed. Stock values plummeted.

“Now, typically in these situations there would be an anticipated demand response, (with) low prices, people would consume more or stockpile more in anticipation of future higher prices,” said Birn.

“But in this situation the likelihood is demand is not going to respond at all, if anything it could fall further, exacerbating the difference between supply and demand and pushing prices lower,” he said.

The impact of the coronavirus pandemic isn’t subsiding, he said.

“It’s going to get worse before it gets better most likely and so in addition to the oil market situation, extremely low-price environment, reductions in (capital expenditures), we have a broader economic issue developing.

“The impacts of this are not going to be just felt in 2020, for the oil market they’re going to reverberate into future years for certain,” he said.

Economic stimulus. Of course, it’s not just the oil industry in trouble at the moment. The situation for Canada’s entire economy “is very serious,” said Antunes.

And certain segments, “are going to be very, very hard hit,” he said.

“The tourism sector, the service sector in general is going to be really, I think, decimated in the coming quarter.”

On Wednesday, the federal government announced it would provide temporary income support for Canadians who are quarantined or caring for children and who don’t have paid sick leave, including up to $900 bi-weekly for 15 weeks for workers who are quarantined and don’t qualify for Employment Insurance sickness benefits. For those who do qualify for EI sickness benefits, the one-week waiting period has been waived. Additional income support will be provided for workers who are facing unemployment but are unable to collect insurance, low-income families, and families with children.

For businesses, the federal government is proposing to offer small employers a temporary wage subsidy of up to $25,000 per employer over three months. This comes on top of Finance Minister Bill Morneau’s announcement on March 13 that the government is establishing a Business Credit Availability Program to provide more than $10 billion in loans to support businesses. The Bank of Canada has also lowered its overnight rate target to 0.75 per cent.

CIBC economists said in a note Wednesday that the “announcement from Canada’s Prime Minister and Finance Minister today are the latest steps taken that should cushion the blow, but which cannot prevent, a Coronavirus recession that is now underway.”

“A recession is still inevitable, with a deep dive coming in Q2 due to near-mandated cuts in household spending here and in our export markets, an oil industry shock, and potential supply disruptions from domestic and foreign producers.”

A further contraction is also expected in the third quarter, the note said.

“But the measures announced today support the likelihood of a V-shaped bounce back once the disease issues have crested.”

In a report released Tuesday, the Conference Board of Canada forecasted Canada’s economy will contract by 2.7 per cent in the second quarter of 2020.

“With the economy already on precarious footing, the added shocks of the recent rail blockade protests, the arrival of COVID-19, and a collapse in oil prices have brought the country to the brink of recession,” the board’s economic forecast says.

The conference board said it expects a return to growth by the third quarter but noted “there are huge downside risks to our outlook due to the unpredictability of the Coronavirus pandemic.”

“Overall, we expect growth of just 0.3 per cent in 2020,” the report said.

Alberta’s economy is expected to take the hardest hit among the provinces, according to RBC’s March 2020 provincial outlook, which is forecasting a 2.5 per cent decline in the province’s GDP for 2020. “For Alberta, this shelves any prospect that the economy will finally recover the output lost during the 2015-2016 downturn,” the report reads.

Alberta Premier Kenney said his government is working on its own economic recovery package that could include more than $3 billion in economic stimulus. Given the instability of markets, the number of people in self-isolation, and the suspension of some industries as a result of the COVID-19 pandemic, the province is planning to focus on liquidity for households and businesses in the short-term, with a second-phase focused on fiscal stimulus measures such as investments in infrastructure, Kenney said.

From the federal government, Kenney asked for targeted support for the province’s oil industry, alongside enhanced access to employment insurance, including for self-employed workers, and payroll tax relief for employers. In advance of federal announcements this week, the premier had said he wants the federal government to ensure companies have access to capital, to direct funding to stimulate emissions reducing technology and job-creation focused wellsite remediation.

Last week, Kenney said the industry also needs relief from environmental measures such as the forthcoming clean fuel standard and methane regulations, which, he said, could add significant costs to “an industry that is in many respects on life support.”

Addressing two crises at once. Conference Board of Canada chief economist Antunes said measures to help lessen the burden of holding on to employees, such as relief from payroll taxes, improving access to capital, and infrastructure investments may be the more prudent approach.

“For Canada, we do have to have a social licence, we do have to set out our environmental targets and make sure that we’re on track to achieving those. I’m not convinced that we will achieve them, but it’d be hard to delay or postpone some of those measures,” he said.

As it stands, Canada is already on track to exceed its 2030 emissions target. Current projections show the country needs to cut another 77 million tonnes over the next 10 years in order to hit its target. That’s roughly equivalent to the greenhouse gases emitted by 16.6 million cars over the course of a year, according to the U.S. Environmental Protection Agency.

For Woynillowicz, the deputy director of Clean Energy Canada, the focus should be on finding ways to stimulate the economy today that fit with Canada’s commitments to reduce emissions and transition the economy.

As for the oil and gas industry, Woynillowicz said he supports Kenney’s call for investments to clean-up orphaned well sites, an initiative that would both create jobs and address a massive public liability. On Wednesday, Morneau said the federal government will make a “significant investment in orphan well remediation to help both companies and workers in the province.”

Woynillowicz said governments could also target stimulus dollars to methane-reducing initiatives. Such programs could create jobs and “help the competitiveness of the sector in terms of its climate performance,” he said.

As for the clean fuel standard, it may seem like a burden to some sectors of Alberta’s economy, but Woynillowicz said there’s an opportunity for farmers and the forestry sector in biofuels.

“There are two sides to that coin and I think it’s unfair to just narrowly look at the cost to some and ignore the opportunities and the benefits for others,” he said.

There’s also an opportunity for the federal government to direct stimulus dollars to smaller companies looking at ways to harness Alberta’s hydrocarbons as a source of hydrogen or carbon, he said.

“There is innovation happening within the sector, in terms of trying to evolve beyond just pumping oil and gas for the purpose of burning it,” he said.

“So, target the support to those sorts of things which are supportive of the industry both in the immediate term, but also are setting the industry up to remain competitive for longer than it otherwise would be if we were to just flow money into doing more of what we’ve been doing in the past.”

As for Alberta’s oil companies, after reviewing the list of approved projects the Alberta Energy Regulator provided to National Observer, IHS Markit’s Kevin Birn said he doesn’t expect the proposed projects to move forward in this current environment.

“In the current price environment that has emerged in the last week, it’s not foreseeable any of these things are going to go forward at this point in time,” he said, during an interview earlier this month.

“Eventually as the prices come up you could see some of them come back in,” he said. “But in these environments the number one priority for companies is to preserve cash because they don’t know how deep the price collapse could be.”

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Keywords: COVID-19, Coronavirus, climate change, oil sands, tar sands

Topics: Analysis, Climate Change

Great Information. The effect of COVID 19 on the major economies has been enormous. With forced lockdowns and low consumer confidence, the businesses are facing huge uphill task to remain operational while meeting their fixed costs.