Introduction: The unintended—and undermanaged—consequences of blockchain and cryptocurrency

By Dan Drollette Jr | July 11, 2022

Introduction: The unintended—and undermanaged—consequences of blockchain and cryptocurrency

By Dan Drollette Jr | July 11, 2022

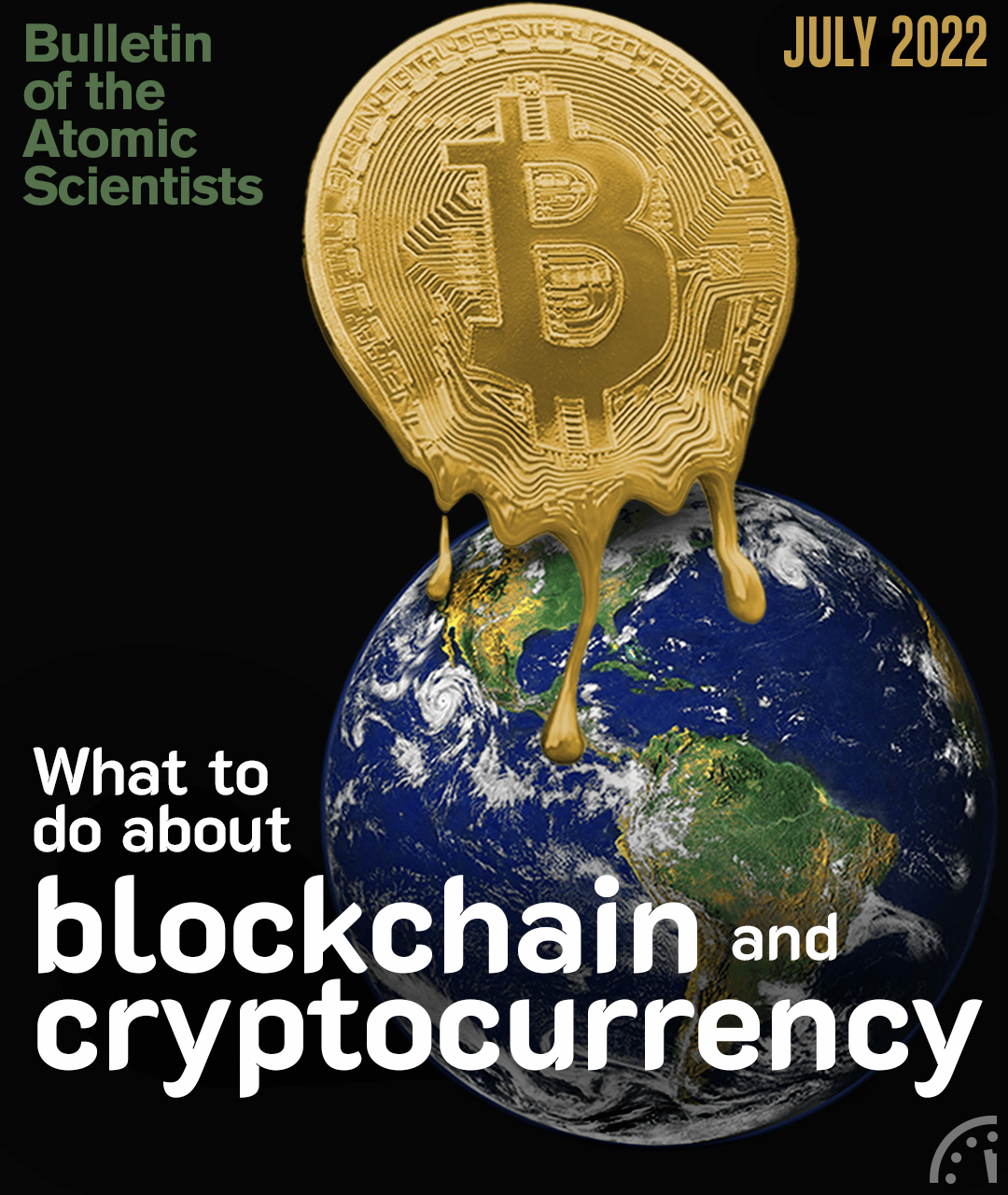

The creation of the virtual currency known as bitcoin—via a process known as “mining” that consists, actually, of the use of brute computing force to solve a cryptographic puzzle—comes with a considerable environmental toll. Each so-called “coin” requires extraordinarily large amounts of electricity to produce, and if that electricity comes via the burning of fossil fuel, significant amounts of carbon dioxide are added to the atmosphere, exacerbating climate change.

Negative environmental impacts notwithstanding, bitcoin and other so-called “cryptocurrencies” have become popular. By some accounts, there were as many as 18,000 different forms of cryptocurrency at one point, and the overall value of those digital currencies topped $1 trillion. But ever since the bitcoin concept was introduced in an obscure journal over a dozen years ago—a lifetime in the computing world—there has been a lot of mystery as to what, exactly, was involved.

Enthusiasts evangelize for a form of currency not controlled by governments or other intermediaries and secured through distributed ledger technology, a sort of decentralized database in which users share responsibility for maintaining the ledger and validating its accuracy. And enthusiasts have certainly been enthusiastic, claiming that cryptocurrencies and the blockchain (perhaps the most well-known distributed ledger technology) will provide investors with privacy, freedom from government control, protection from payment fraud, and—perhaps most important in the eyes of the biggest boosters—the potential for high returns as crypto grows as a currency. Or a digital asset. Or a security. Or whatever is created when a computer solves a difficult cryptographic puzzle of a certain type.

The very fact that cryptocurrency is so hard to define may have contributed to the recent spectacular crash in crypto values, a perfect storm of negative factors that led a single Bitcoin drop to nearly half its worth in less than six months, and the so-called “stable currency” known as Luna lose 97 percent of its value in 24 hours. More than $300 billion in crypto value evaporated in just one week in May.

If crypto’s value and positive attributes are difficult to nail down precisely, it is clear that the increasing use of and investment in bitcoin and other virtual currencies presents governments around the world with real financial regulation problems—and many potential security concerns.

Probably the most immediate concern for consumers revolves around whether they can simply trust what bitcoin and its rivals are doing as they try to transform the basic underlying structure of finance and currency. Eswar Prasad, an economist at Cornell University and author of The Future of Money: How the Digital Revolution is Transforming Currencies and Finance, addresses that issue and others in the first essay for this issue, which also acts as something of a primer on blockchain and bitcoin.

Perhaps the biggest overarching global concern about the rise of crypto, however, involves the effect that bitcoin mining has on climate change. As shown in the article “How bitcoin makes burning fossil fuels more profitable than ever” by Bulletin associate editor Jessica McKenzie, investors are buying old, defunct coal-burning power plants and retooling them to exclusively generate bitcoins—regardless of what that does to the utility bills, health, and environment of their neighbors, and regardless of how the process exacerbates climate change.

While cryptocurrency evangelists tout a financial utopia freed from central control, others see a buzzword-heavy mechanism for hiding money—a system that enables black markets, drug-dealing, corruption, terrorism, and money-laundering.

However, there could be real benefits to having some form of decentralized, distributed system for tracking account balances and transactions, as Aaron Arnold of the Royal United Services Institute’s Centre for Financial Crime and Security Studies writes in his Bulletin article “Stolen billions from errant mouse clicks: Crypto requires new approaches to attack money-laundering.” The underlying technology that powers bitcoin, known as the blockchain (or more formally as distributed ledger technology), is actually fairly sound; banks might find advantages to using that technology as appropriate. But, Arnold writes, policy makers must enact brave new regulations to deal with a brave new world of virtual assets and how they affect issues of national security, particularly as regards terrorism.

And in an unexpected twist, blockchain technology could be a good thing for nuclear nonproliferation, in that it can be used to help with nuclear security and nuclear safeguards management—the tracking and accounting for all nuclear materials, nuclear waste, and radioactive substances. At least, that was the conclusion of a new in-depth study from the Stimson Center, as explained by authors Cindy Vestergaard and Lovely Umayyam.

With the crash of cryptocurrencies, it may be that policy makers and the public are getting a much-needed opportunity to catch their breath, re-think, re-tool, and re-make the playing field for this new currency, so that it can deliver tangible benefits without detrimentally affecting international security, the oversight of rogue regimes, and the battle against climate change.

Together, we make the world safer.

The Bulletin elevates expert voices above the noise. But as an independent nonprofit organization, our operations depend on the support of readers like you. Help us continue to deliver quality journalism that holds leaders accountable. Your support of our work at any level is important. In return, we promise our coverage will be understandable, influential, vigilant, solution-oriented, and fair-minded. Together we can make a difference.

Some real misinformation here about cryptos impact on energy usage. In the hunt for cheaper power, a lot of miners were based in China before they banned it (so it doesn’t compete with their CBDC) and those miners used hydro power and redundant energy (that was an excess of and would otherwise go to waste). Also, the crypto industry is heavily driving forward the use of renewable energy. TL;DR Crypto did originally use lots of fossil fuel power, now its helping drive the use of renewable energy or switching to Proof of Stake which in itself consumes a lot less… Read more »

This article doesn’t contain misinformation, I could argue that your post does though… crypto mining is massively energy intensive and is largely fuelled by hydrocarbons. China banned crypto currencies but is still one of the largest centres of crypto mining due to its cheap fossil fuelled energy